Can Shriram Finance’s Q3 FY26 Revenue Growth Offset Pressure on Profitability?

Source: shutterstock

Shriram Finance’s Q3 FY26 performance reflected steady business momentum, supported by ongoing lending activity across its core segments. The company continued to focus on balance-sheet-led growth while maintaining a vehicle-centric portfolio mix. Customer reach expanded through higher digital adoption and wider engagement beyond the existing base. Overall operations indicated continuity in business execution during the quarter.

Revenue Growth Reflects Steady Business Momentum

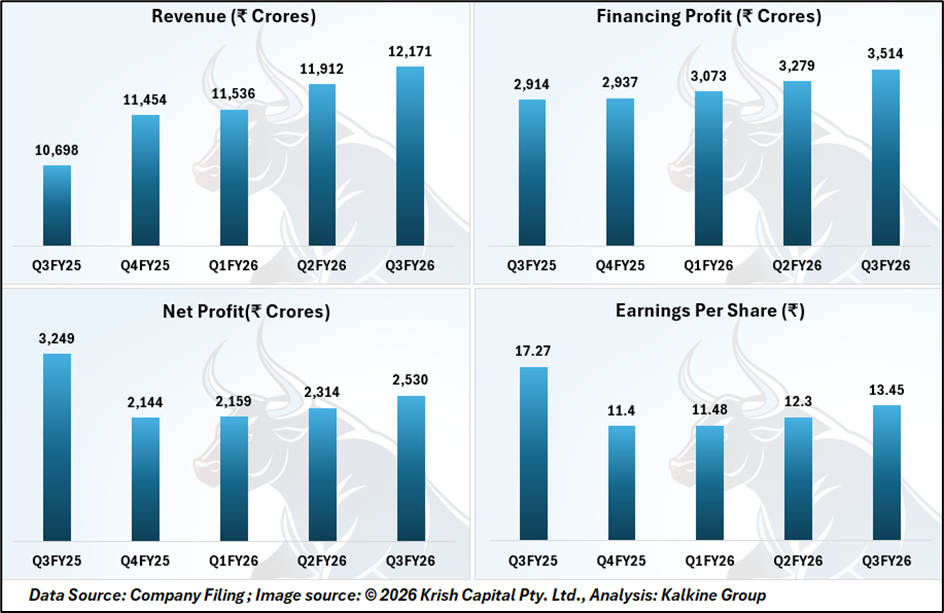

Shriram Finance reported year-on-year growth in its top line during Q3 FY26, with revenue rising approximately 13.8% to INR 12,171 million compared with INR 10,698 million in Q3 FY25. The increase was driven by sustained lending activity across its primary financing segments. Financing profit also improved during the quarter, increasing by nearly 20.6% year-on-year to INR 3,514 million. The rise in financing income points to improved yield management and continued loan disbursements, even as competitive conditions persisted in the broader credit environment.

Despite revenue growth, profitability remained under pressure. Net profit for Q3 FY26 declined around 22.1% year-on-year to INR 2,530 million, compared with INR 3,249 million in the corresponding quarter of the previous fiscal year. Earnings per share followed a similar trajectory, decreasing from INR 17.27 to INR 13.45. The year-on-year decline reflects the impact of weaker performance in Q4 FY25, followed by a gradual recovery across subsequent quarters, resulting in lower comparative profitability.

Asset Base Expansion Driven by On-Book Growth

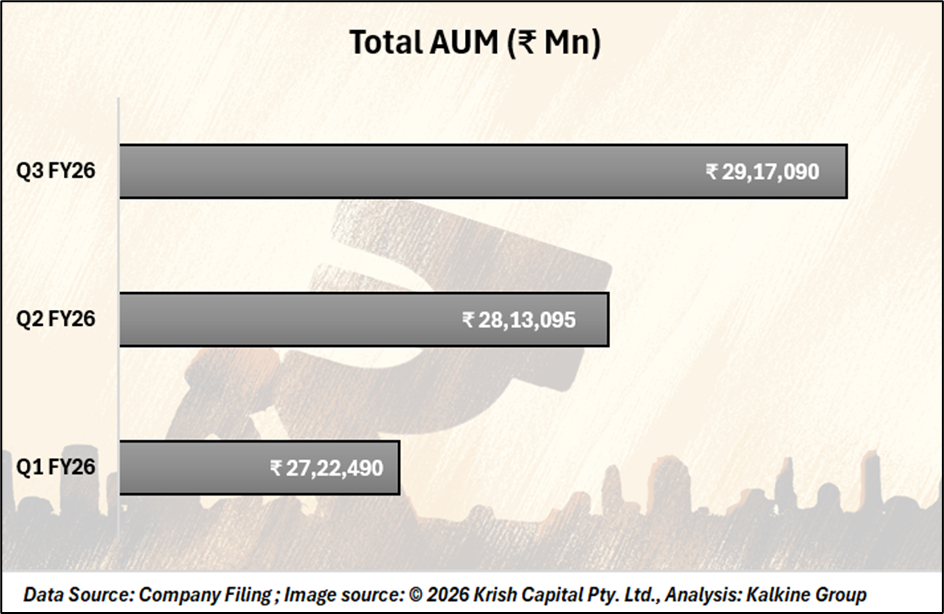

Total assets under management increased approximately 14.6% year-on-year to INR 2,917,090 million in Q3 FY26. Growth was largely supported by on-book expansion. Balance sheet assets rose nearly 17.1% to INR 2,501,092 million, while total on-book assets increased about 15.2% to INR 2,893,342 million. In contrast, off-book assets declined by roughly 28.1%, indicating a shift toward balance-sheet-based growth rather than securitization-led expansion.

Portfolio Composition Remains Vehicle-Focused

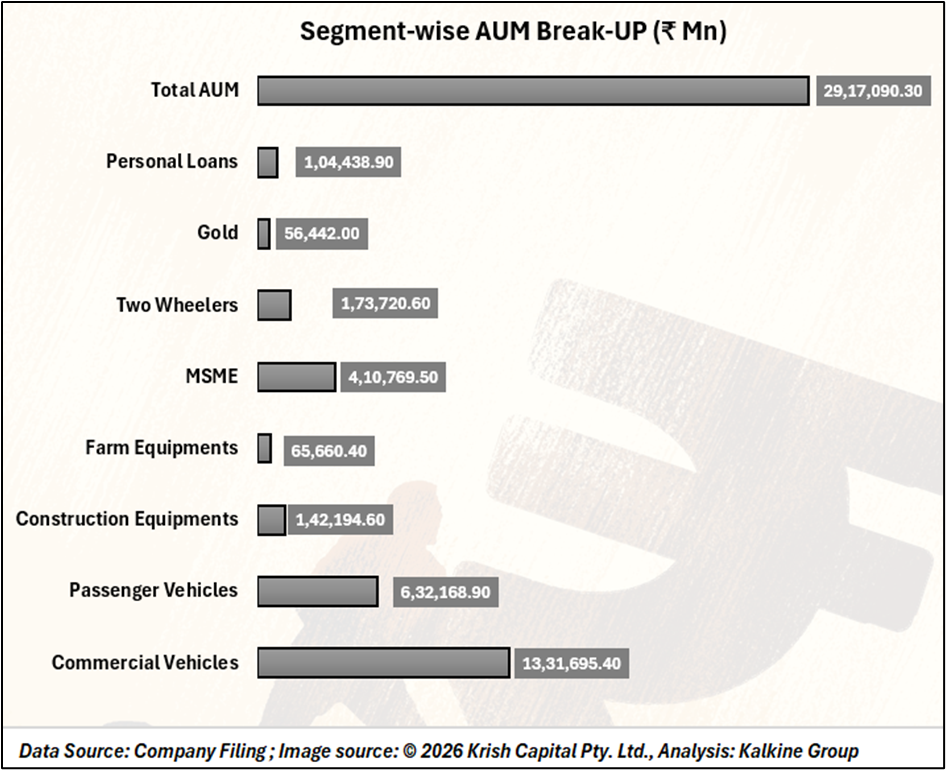

The AUM mix continues to be centered on vehicle financing. Commercial vehicle loans accounted for about 45.7% of total AUM, while passenger vehicles represented nearly 21.7%. MSME loans contributed around 14.1%. Two-wheelers and construction equipment formed approximately 6.0% and 4.9%, respectively. Other segments, including personal loans, farm equipment, and gold loans, comprised a relatively smaller share of the portfolio.

Digital Adoption Expands Customer Reach

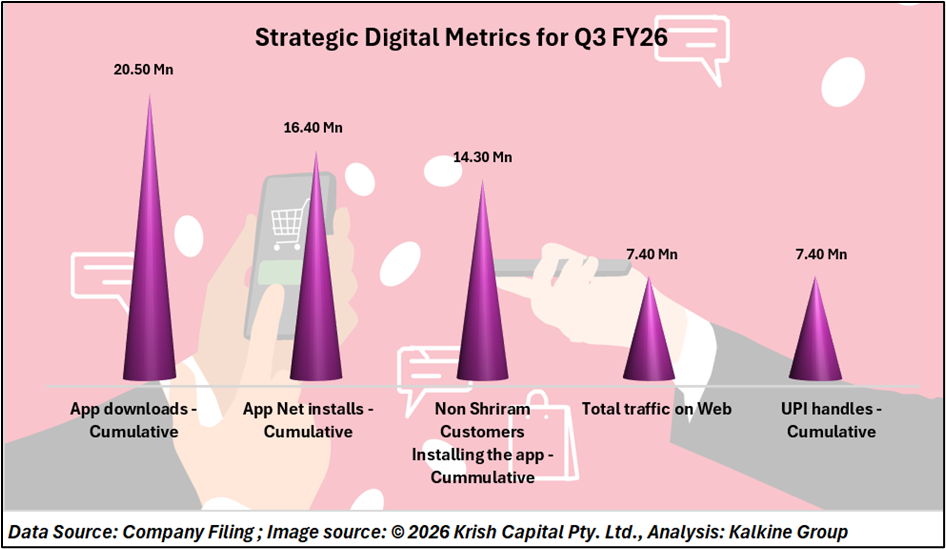

Digital engagement showed continued progress in Q3 FY26. Cumulative app downloads reached 20.5 million, with net installs at 16.4 million. Around 87% of installs originated from non-existing customers. Web traffic stood at 7.4 million, broadly aligned with cumulative UPI handles, reflecting ongoing adoption of digital platforms.

Technical Summary

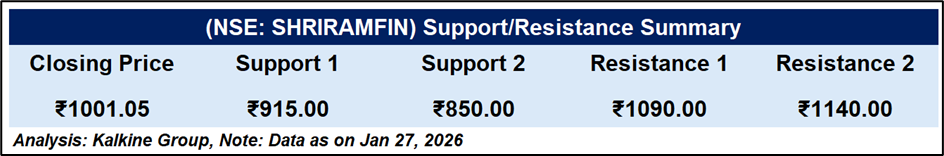

Shriram Finance (NSE: SHRIRAMFIN) closed at ₹1,001.05, marginally lower on the day. The stock continues to trade well above its 50-day EMA (~₹916), indicating a strong underlying uptrend. RSI (14) near 63 reflects positive momentum, though slightly off recent highs. The trend remains bullish, with immediate support around ₹915–850, while resistance is seen near ₹1,090–1,140.

Conclusion

Shriram Finance’s Q3 FY26 revenue grew 13.8% to ₹12,171M, driven by vehicle-focused lending and balance-sheet expansion. Despite higher financing profit, net profit fell 22.1% to ₹2,530M. Digital adoption boosted customer reach, while technicals show resistance at ₹1,012–1,023 and support at ₹985–957.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.