Can Swiggy Sustain Leadership While Expanding Multi-Service Growth Profitably

Source: shutterstock

Swiggy Limited delivered a resilient and strategically significant performance in Q3 FY26, reinforcing its leadership in India’s hyperlocal commerce ecosystem. The quarter reflected a careful balance between accelerating growth and improving unit economics, supported by strong execution across food delivery, quick commerce, and out-of-home consumption. With user engagement rising and margins steadily improving, Swiggy demonstrated that scale and sustainability can progress together.

Platform Momentum Strengthens Across Services

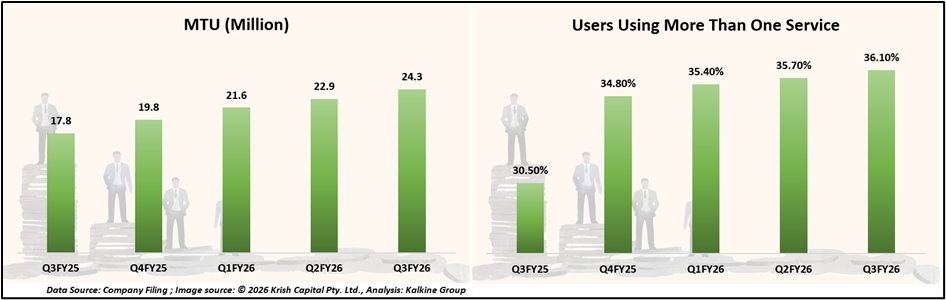

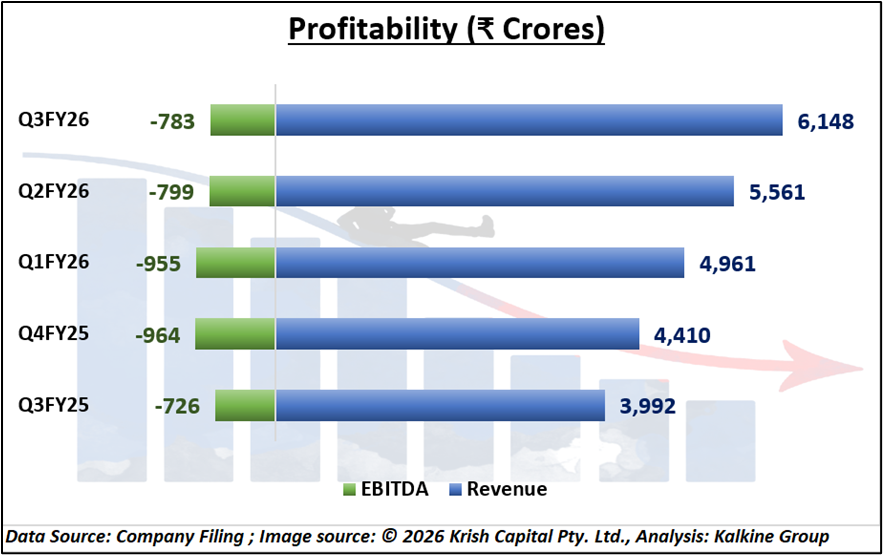

At the platform level, Swiggy continued to deepen its consumer reach, with average monthly transacting users (MTUs) growing 36.8% year-on-year to 24.3 million. This growth highlights increasing multi-service adoption across food delivery, Instamart, and Dineout. Consolidated Adjusted Revenue rose a strong 50.8% YoY to ₹6,431 crore, driven by higher order volumes, improved advertising monetization, and subscription-led affordability initiatives. While Consolidated Adjusted EBITDA remained in loss, sequential margin improvement reflected growing operating leverage as the platform scaled.

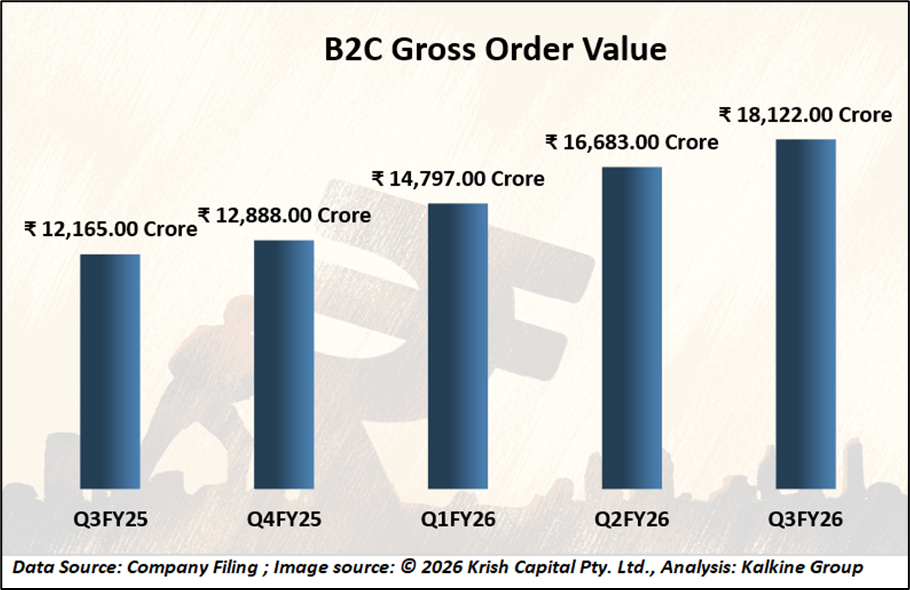

Swiggy posted strong growth in Q3FY26, led by food delivery GOV rising 20.5% YoY to ₹8,959 crore and monthly users increasing 22% to 18.1 million. Food delivery profitability improved, with adjusted EBITDA up 13.1% QoQ and margins reaching a two-year high of 3.0% of GOV. Instamart continued hypergrowth, with GOV doubling YoY to ₹7,938 crore, driven by network expansion and higher order values. Consolidated revenue climbed to ₹6,148 crore, while EBITDA losses narrowed sequentially, signalling improving operating leverage.

Disciplined Investments Signal Long-Term Focus

While quick commerce Adjusted EBITDA losses increased to ₹908 crore due to continued investments in marketing and infrastructure, contribution margins improved sequentially.

Swiggy consciously avoided deep discount-led growth, prioritising sustainable economics over short-term volume gains. The company reiterated its guidance for achieving contribution breakeven in quick commerce by Q1 FY27, underscoring its long-term strategic discipline.

B2C Gross Order Value

Out-of-Home Consumption Emerges as a Profit Lever

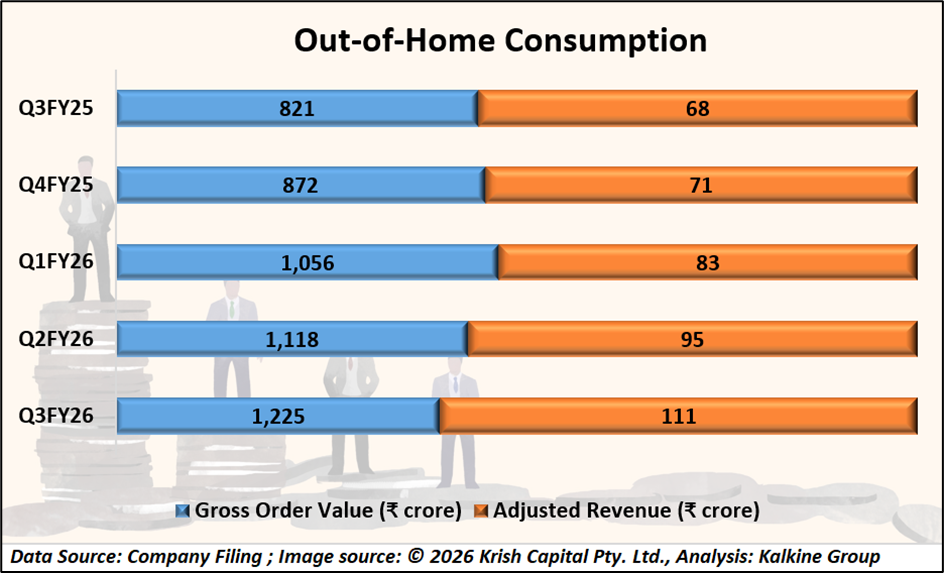

Swiggy’s Out-of-Home Consumption business continued its turnaround, recording nearly 50% YoY growth and delivering a positive Adjusted EBITDA margin of 0.7%. Rising restaurant participation, increased advertising income, and deeper integration of Dineout strengthened the segment’s profitability profile, making it an increasingly important contributor to the overall ecosystem.

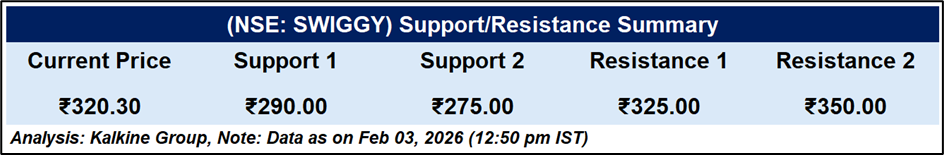

Technical Summary

Swiggy was trading at ₹320.30, below its 50-day EMA, indicating a prevailing bearish trend. RSI near 38 signals oversold conditions, hinting at a possible short-term bounce. Immediate support lies at ₹290, followed by ₹275. Resistance is seen at ₹325 and ₹350. A breakout above ₹325 may improve sentiment, while a break below ₹290 could extend downside.

Conclusion: A Platform Built for Enduring Value

Swiggy’s Q3 FY26 results reflect a maturing platform that is successfully aligning scale with sustainable economics. Strong user growth, improving food delivery margins, and the profitable turnaround in out-of-home consumption highlight operational depth beyond headline growth. While quick commerce remains investment-heavy, sequential margin improvement and clear breakeven visibility reinforce management’s disciplined approach.

Swiggy is demonstrating that leadership in hyperlocal commerce is no longer driven by discount intensity but by execution, ecosystem monetisation, and operating leverage. Supported by balance sheet strength and capital flexibility, the company appears structurally better positioned to generate long-term shareholder value.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.