Coal India Extends Rally After Board Clears Path for MCL, SECL Listings

Source: Shutterstock

Coal India Limited (NSE: COALINDIA) shares jump ~3% on December 24 touching a seven-month high, after the board granted in-principle approval to list two subsidiaries Mahanadi Coalfields Limited (MCL) and Southeastern Coalfields Limited (SECL). The stock extended gains for a sixth consecutive session, indicating sustained market interest following the announcement. The proposed listings remain subject to regulatory approvals and align with broader disinvestment guidance over the coming years.

MCL and SECL account for a significant portion of Coal India’s coal production and reserves. Their scale and operational footprint position them as key contributors within the group. The move is expected to bring clearer subsidiary-level disclosure and sharper operational segmentation, though timelines and valuation outcomes remain contingent on regulatory processes.

Q2 FY26: Earnings Under Pressure

Coal India reported weaker financial performance in Q2 FY26 compared with the previous quarter. Revenue declined to ₹30,187 crore from ₹35,842 crore in Q1 FY26. Operating profit fell to ₹6,716 crore, while operating margin narrowed sharply to 22% from 35%, reflecting pricing and cost-related pressures.

Net profit dropped to ₹4,263 crore versus ₹8,734 crore in the preceding quarter. Earnings per share moderated to ₹7.07 from ₹14.19, indicating a broad-based sequential slowdown across profitability metrics during the quarter.

H1 FY26: Volumes Ease, Costs Rise

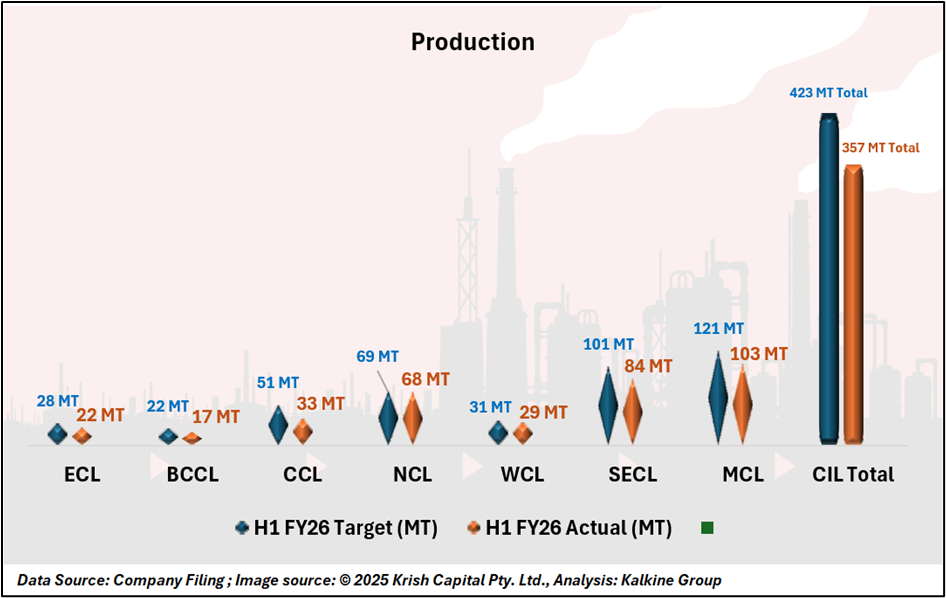

For H1 FY26, Coal India reported a mixed operational and financial performance. Coal production declined 3% year-on-year to 357.08 MT, while coal offtake also fell 3% to 329.14 MT. Overburden removal decreased 3% to 855.78 million cubic metres, pointing to moderated mining activity across subsidiaries.

Inventory levels reduced to 78.70 MT as of September 30, 2025, marking a 27% decline from March-end and contributing to improved working capital positioning.

Strategic and Non-Coal Developments

During the period, Coal India progressed on diversification initiatives, including revenue-sharing mining models, renewable energy plans such as a 500 MW solar project, and incorporation of a renewable subsidiary in Rajasthan. The company also received its maiden dividend of ₹404.37 crore from joint venture HURL, reflecting incremental non-coal income contribution.

Technical Analysis

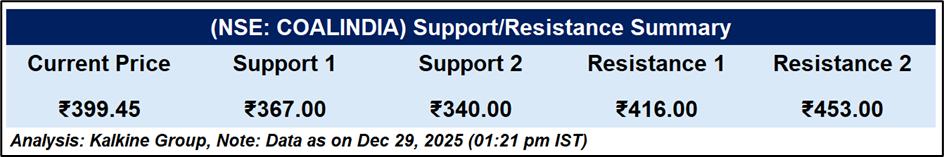

Coal India is trading at ₹399.45, consolidating below the ₹408–410 resistance zone. The stock remains above its 50-day EMA (~₹385), keeping the short-term trend constructive. RSI near 67 signals strong momentum but hints at near-term consolidation. Support lies at ₹340–367, while a sustained move above ₹416 could trigger further upside.

Conclusion

Coal India’s near-term sentiment is supported by the proposed subsidiary listings and a constructive technical setup. However, earnings pressure, softer volumes, and margin compression temper the outlook. Sustained upside will depend on regulatory clarity, operational recovery, and a decisive breakout above key resistance levels.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.