Could Adani Enterprises Be India’s Most Ambitious Growth Stock in FY26?

Source: Shutterstock

Adani Enterprises Ltd (ADANIENT), the flagship company of the Adani Group, has announced its consolidated results for the quarter and nine months ending December 31, 2025, demonstrating resilience and strategic growth across its diversified infrastructure and renewable energy portfolio.

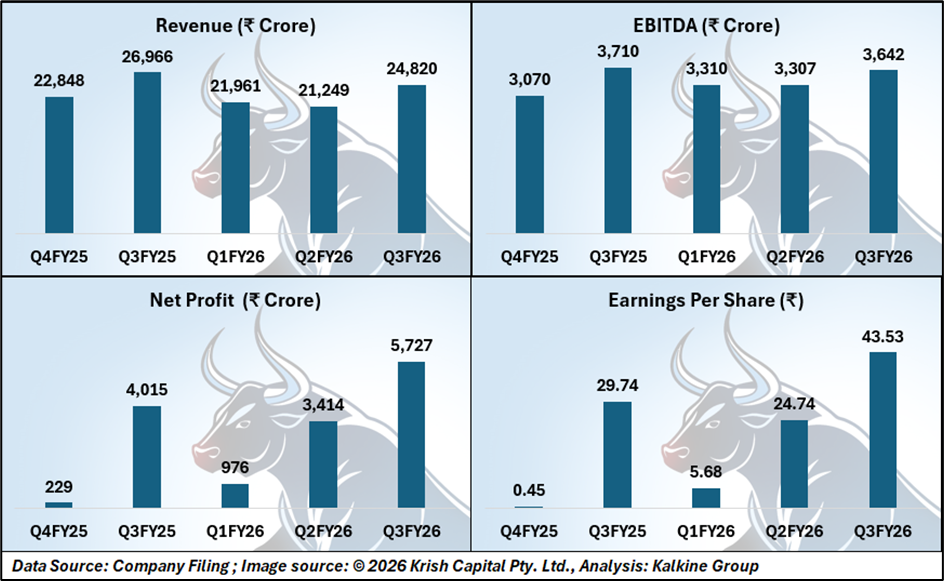

Consolidated Financial Highlights: Strong Operational Performance

For 9M FY26, Adani Enterprises reported consolidated revenue of ₹69,756 crore, slightly down 4% YoY, while EBITDA stood at ₹11,985 crore, a marginal decline of 3%. Profit Before Tax (PBT) excluding exceptional gains reached ₹3,581 crore, bolstered by the exceptional gain of ₹9,215 crore from the sale of AWL stake and cement units to Ambuja Cements Ltd.

The quarter itself reflected growth, with Q3 FY26 revenue rising 8% YoY to ₹25,475 crore, and EBITDA increasing 15% YoY to ₹4,297 crore. Profit After Tax attributable to owners surged impressively to ₹5,627 crore, marking a nearly 90x increase compared to Q3 FY25, demonstrating the company’s operational efficiency and strategic asset monetization.

Adani New Industries & Renewable Energy: Global Recognition

Adani Solar (ANIL) continued to shine as India’s only representative in the Top 10 global solar manufacturers. During Q3 FY26, domestic solar module sales rose 40% YoY to 997 MW, while wind turbine generator (WTG) units supplied increased 38% YoY to 66 sets.

ANIL’s EBITDA for 9M FY26 stood at ₹3,359 crore, reflecting a temporary 8% YoY dip, while PBT declined 17% YoY to ₹2,528 crore. These figures reflect continued investments in scaling green hydrogen and renewable manufacturing capabilities.

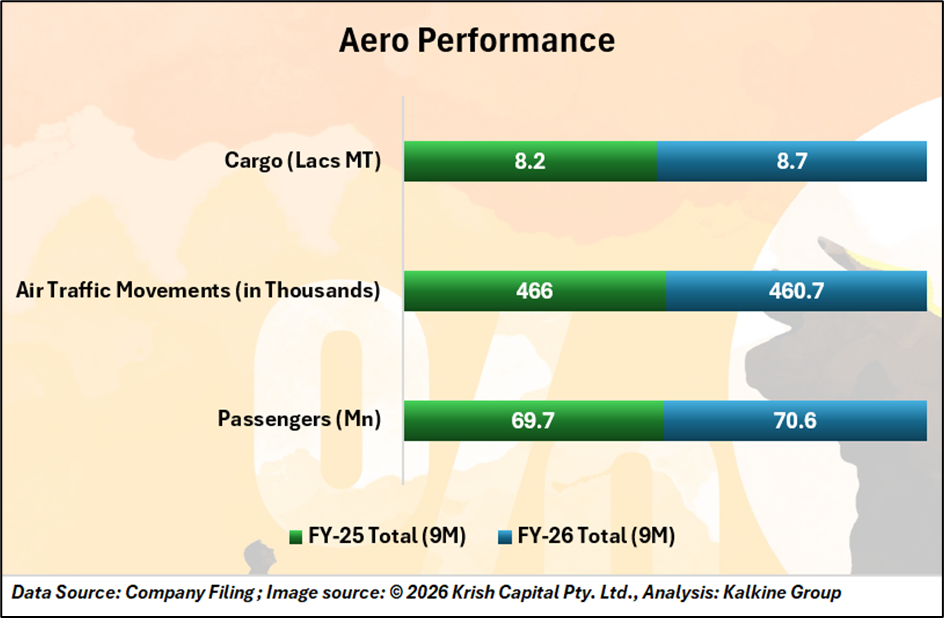

Airports: Landmark Navi Mumbai Airport Commences Operations

A key highlight for the period was the commencement of operations at the greenfield Navi Mumbai International Airport on December 25, 2025. With a Phase I capacity of 20 million passengers per annum, this development underscores Adani’s rapid execution capabilities, achieving a greenfield airport project in under five years of acquisition.

Roads, Data Centers, and Mining: Diversified Growth

Adani Road Transport Ltd (ARTL) operationalized two new HAM road projects, bringing the total to nine operational projects. However, road construction volumes declined 22% YoY to 1,341 L-KM due to project ramp-ups.

In the data center segment, AdaniConnex Pvt Ltd (ACX) commissioned 14.4 MW capacity in the quarter, bringing total operational capacity to over 50 MW, with Pune Phase I and Hyderabad Phase II data centers now fully operational.

Mining services continued to perform robustly, with dispatch volumes up 14% YoY to 33.3 MMT. Conversely, integrated resource management (IRM) volumes declined 14% YoY, reflecting cyclical industry trends.

Capital Markets & Strategic Fundraising

AEL successfully raised ₹24,930 crore through its rights issue, oversubscribed by 30%, and raised ₹1,000 crore through its 3rd NCD public issue in January 2026. These fundraises provide strong backing for AEL’s ongoing expansions across airports, roads, renewable energy, and data centers.

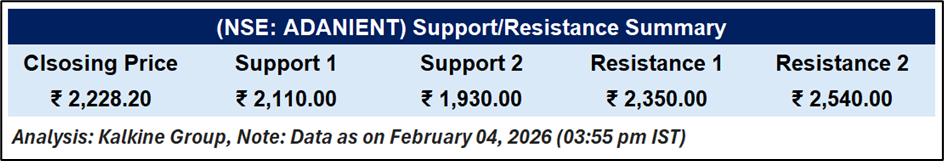

Technical Summary

Adani Enterprises Ltd has staged a technical rebound from recent lows, closing at ₹2,220.80 and reclaiming short-term momentum. The stock remains below its 50-day SMA near ₹2,190, indicating cautious optimism. RSI near 58 signals improving strength, though sustained upside requires confirmation above ₹2,300. Volume remains moderate, suggesting selective accumulation.

Outlook: Positioned for Strategic Growth

With operational excellence across multiple sectors, a landmark greenfield airport launch, strong renewable energy performance, and robust capital market support, Adani Enterprises is well-positioned to accelerate growth in FY26 and beyond. As India marches toward a $5 trillion economy, AEL continues to incubate globally competitive businesses with a focus on sustainability, technological leadership, and long-term national impact.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.