DLF Limited Q1 FY26: Record Sales, Surging Profits, and a Blueprint for Sustainable Growth

Source: shutterstock

DLF Limited, India's leading real estate developer, has reported an exceptional first quarter for FY26, achieving record highs across its key operational and financial indicators. These latest results highlight not only the company’s resilience but also its ongoing shift toward sustainable growth with strong profit margins.

Financial Performance

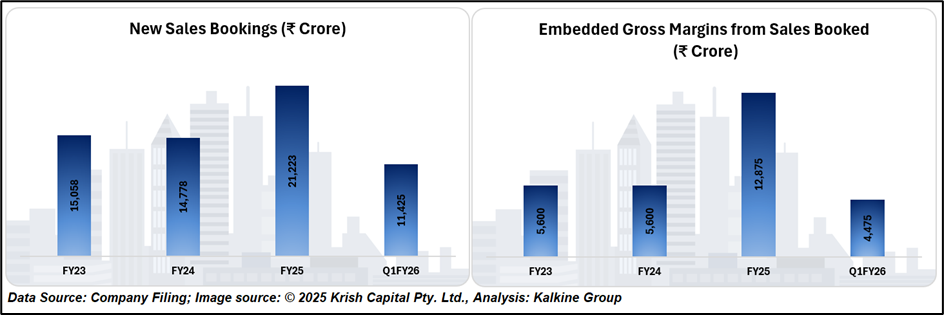

In Q1 FY26, DLF achieved new sales bookings of ₹11,425 crore, representing a significant 78% year-on-year increase, driven largely by successful launches within its Privana development portfolio. Meeting strong demand for premium and luxury residences, the company’s collections for the quarter totaled ₹2,794 crore, generating a healthy operating cash surplus of ₹1,420 crore and a net cash surplus of ₹1,131 crore.

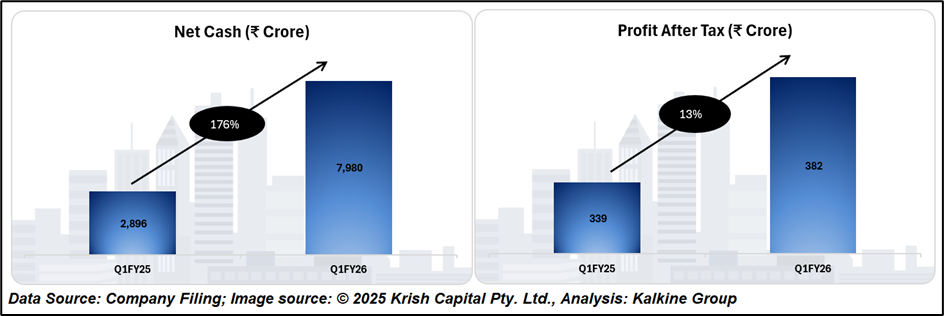

As of June 30, 2025, DLF’s consolidated net cash position improved substantially to ₹7,980 crore, underscoring strong financial management and disciplined capital allocation. The company repaid ₹1,364 crore in debt during the quarter, strengthening its balance sheet and further reducing interest costs.

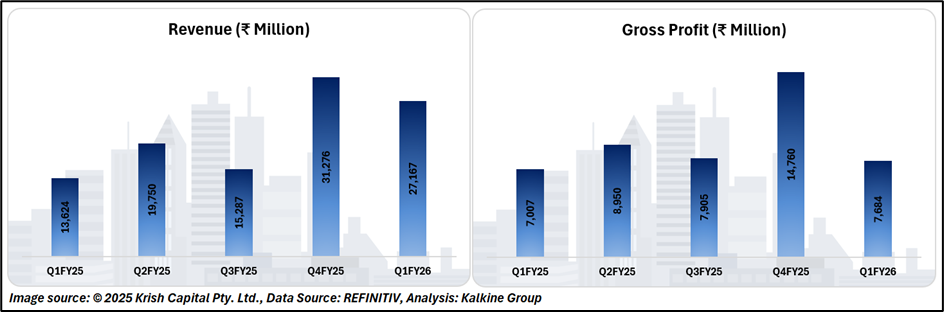

For Q1 FY26, DLF recorded consolidated revenue of ₹2,981 crore and a PAT of ₹766 crore a YoY increase of 19%. EBITDA stood at ₹628 crore, marking a 6% YoY improvement, with the margin at 21%.

Impressive Pipeline and Surplus Potential

The medium-term launch pipeline is robust, with 37 msf of planned projects valued at ₹1,14,500 crore (potential sales). As of June 2025, the surplus cash potential from launched products is estimated at ₹46,500 crore, reflecting a high degree of cash flow visibility.

The gross margin potential from booked sales stands at an impressive ₹24,500 crore, providing a solid base for sustained profitability in the future.

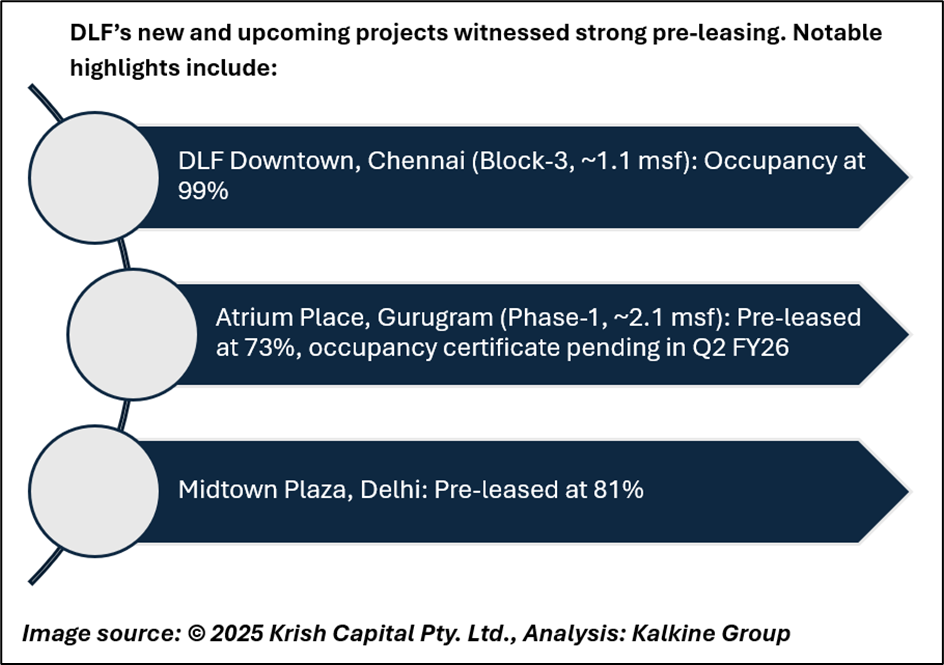

High-Occupancy, High-Quality Rental Portfolio

DLF’s annuity segment, largely operated through its subsidiary DLF Cyber City Developers Ltd (DCCDL), remains a key source of steady income with an overall rental portfolio occupancy of 94%. The office spaces outside SEZs and retail areas achieved a strong occupancy rate of 98%, while SEZ office occupancy stood at a solid 87%. DCCDL reported rental income of ₹1,326 crore in the quarter, a 15% increase year-on-year, reinforcing its position as a consistent contributor to long-term value.

Diversified Business Model and Expansive Land Bank

- Development Business: High-rise condominiums, luxury homes, plotted developments, and commercial sales—all drive high margins.

- Annuity Business: Offices, retail malls, and asset management—not only generate predictable cash flows but enhance the company’s long-term valuation.

- Hospitality Vertical: A growing ecosystem of hotels and clubs complements the real estate offerings.

The company boasts a land bank with a development potential of 188 msf, including substantial upside from transit-oriented development (TOD) and transferrable development rights (TDR) policies.

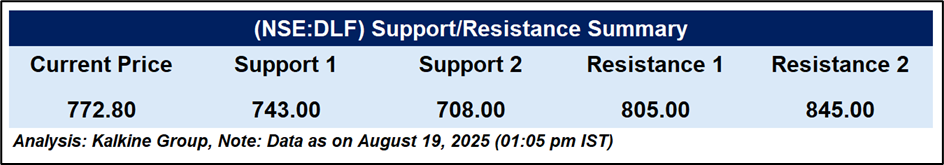

Technical Analysis

DLF Ltd is currently trading at ₹772.80 and exhibiting consolidation following a recent dip. The stock remains below its 51-day EMA of ₹793.85, which points to ongoing short-term weakness. RSI of 43.76 indicates modest bearish momentum, while still staying above the oversold threshold. A decisive move above ₹780 could signal the start of a recovery, while support is expected around the ₹805 level.

Conclusion

DLF Limited’s Q1 FY26 results highlight strong sales momentum, robust cash flows, and a fortified balance sheet, reinforcing its leadership in India’s real estate sector. With a resilient annuity business, expansive land bank, and sustainable growth pipeline, DLF is strategically positioned to deliver long-term value despite near-term market consolidation.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.