Generic Semaglutide Approval Opens New Growth Avenue for Sun Pharma in India

Source: shutterstock

Sun Pharmaceutical Industries Ltd. has received approval from the Drug Controller General of India (DCGI) to manufacture and market a generic semaglutide injection for chronic weight management. This approval enables Sun Pharma to participate in one of the fastest-growing therapy areas globally, driven by increasing incidence of obesity and metabolic disorders in India. The clearance represents a key regulatory milestone and reinforces the company’s focus on expanding its chronic care portfolio.

The product will be introduced under the brand name Noveltreat following the expiry of the semaglutide patent in India. Importantly, the approval is supported by Phase III clinical trials conducted in the Indian population, strengthening confidence in its safety and efficacy for domestic patients. Noveltreat will be available in five dose strengths and delivered through a once-weekly prefilled pen, designed to improve treatment adherence and patient convenience.

Addressing India’s Rising Obesity and Diabetes Burden

Semaglutide, a GLP-1 receptor agonist, has gained global recognition for its effectiveness in weight reduction and glycemic control. In India, where obesity and type-2 diabetes are rising sharply due to lifestyle changes, access to such advanced therapies has remained limited. Sun Pharma has highlighted that this approval aligns with its commitment to improving accessibility to GLP-1 treatments, potentially expanding therapeutic options for a large and underserved patient base.

Strong Market Leadership Supports Commercial Potential

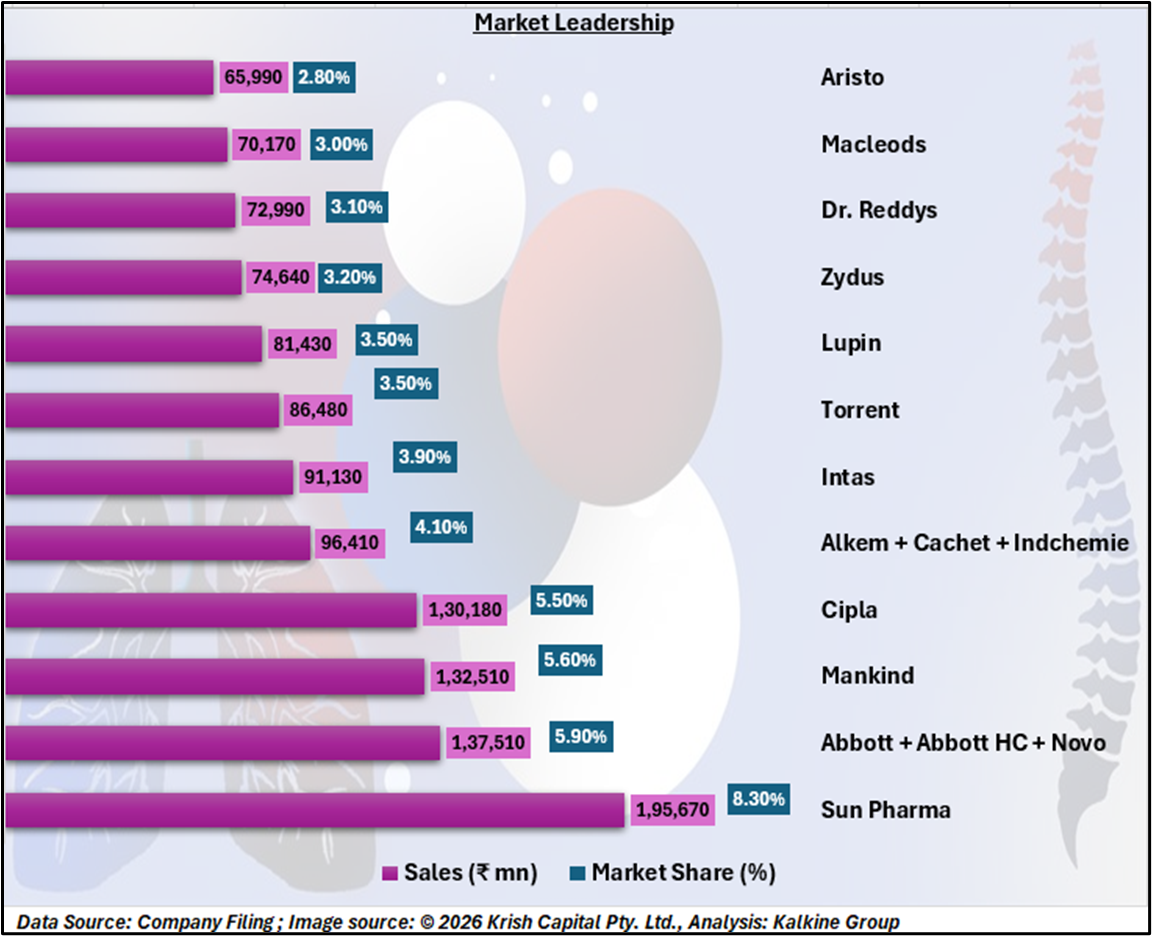

Sun Pharma enters this segment from a position of strength, leading the Indian pharmaceutical market with an 8.3% market share and ₹195,670 million in sales. Competitors such as Abbott (including healthcare and Novo portfolios), Mankind, and Cipla hold market shares of around 5–6%, while Alkem, Intas, Torrent, and Lupin form the next tier. This competitive landscape underscores Sun Pharma’s scale advantage, distribution reach, and brand recall, which could support faster adoption of Noveltreat.

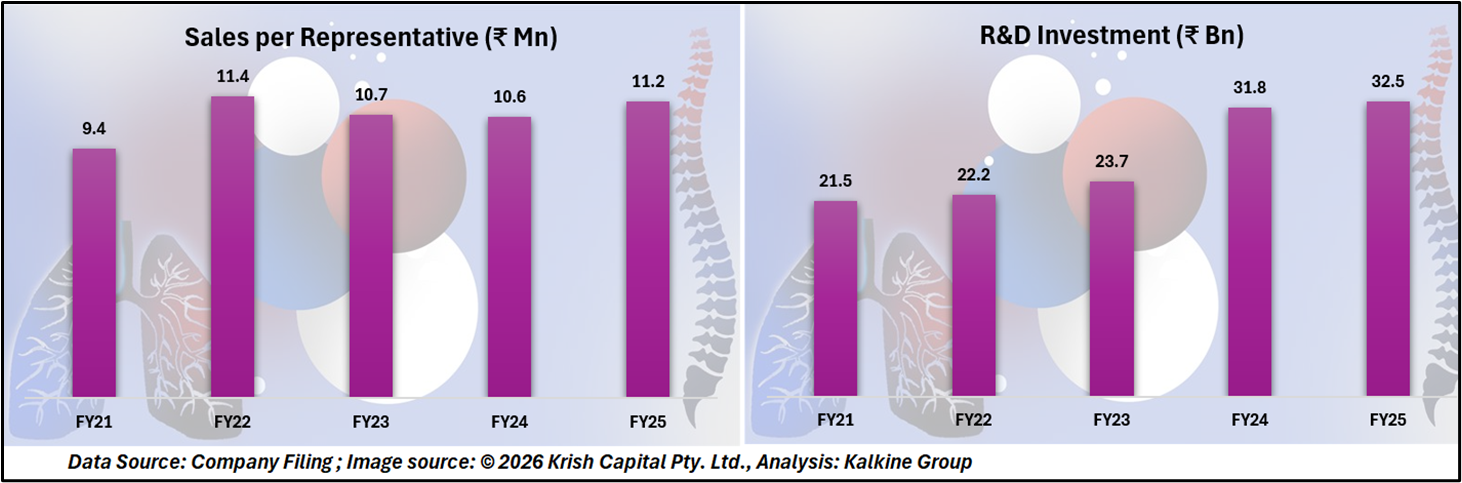

Healthy Financial Performance Provides Execution Headroom

For the quarter ended 30 September 2025, Sun Pharma reported revenue from operations of ₹1,44,052.2 million and total income of ₹1,49,482.3 million. Net profit (PAT) stood at ₹31,179.5 million, reflecting solid margins and operational efficiency. Earnings per share of ₹13 indicated stable earnings performance, providing the financial strength needed to support new product launches and investments in chronic therapies.

Strategic Implications for Long-Term Growth

The DCGI approval for generic semaglutide adds a meaningful growth driver to Sun Pharma’s domestic portfolio. While the full commercial impact will depend on pricing, launch execution, and physician adoption post-patent expiry, the move strengthens Sun Pharma’s positioning in complex and high-value therapies. Over the medium to long term, this development could enhance the company’s leadership in India’s evolving pharmaceutical market while addressing a critical and growing healthcare need.

Consensus Recommendations and Target Price

The stock currently carries a consensus recommendation of 1.94, indicating an overall BUY view from analysts tracking the company. Based on prevailing estimates, the consensus target price stands at ₹1,950.4 per share, which implies an upside potential of around 19.5% from current market levels. Analysts remain constructive on the outlook, supported by the company’s strong domestic presence, expanding specialty portfolio, and steady earnings visibility over the medium to long term.

Technical Summary

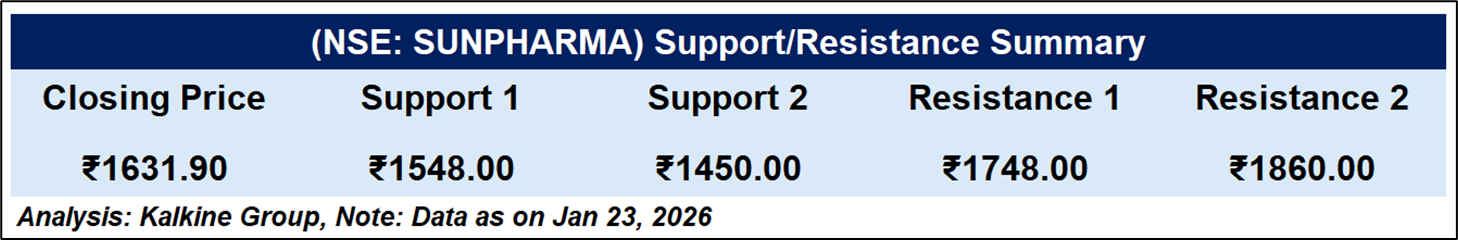

Sun Pharmaceutical Industries Ltd. closed at ₹1,631.90, marginally lower on the day. The stock remains below its 50-day EMA (~₹1,719), indicating a weak short-term trend. RSI (14) near 32 suggests bearish momentum and proximity to oversold territory. Price action points to continued downside pressure, with immediate support around ₹1,548, while resistance is seen near ₹1,748–1,860.

Conclusion

Sun Pharma’s DCGI approval for generic semaglutide marks a strategic expansion into India’s growing chronic care and obesity management market. Backed by local Phase III trial data, the product Noveltreat offers convenience and multiple dose options, positioning the company to address rising diabetes and obesity prevalence. Leveraging its market leadership, strong financials, and distribution network, Sun Pharma is well-placed to drive adoption, strengthen its chronic therapy portfolio, and create a meaningful long-term growth avenue in a high-value segment.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.