Gold Up 100% in Two Years — Why Is the Shine Starting to Dim?

Source: shutterstock

Highlights

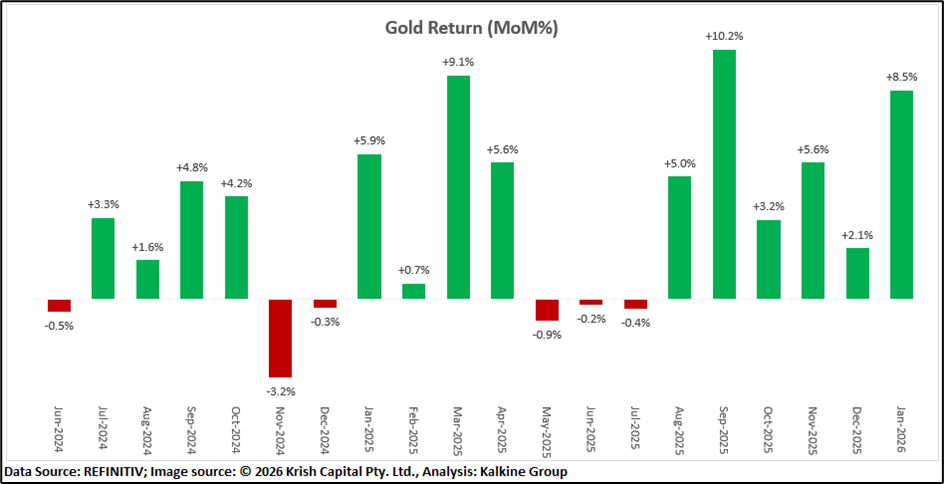

- Strong Upswing Since Mid-2024: Gold prices have advanced more than 100% since June 2024, underpinned by a weaker U.S. dollar, softer interest-rate expectations, and sustained global uncertainty linked to inflation trends and geopolitical developments. These factors have reinforced gold’s role as a defensive allocation.

- Move to Uncharted Territory: Prices surged to a historic peak near USD 5,626.80, supported by heightened risk aversion and a supportive currency backdrop that encouraged flows into precious metals.

- Demand Mix Remains Broad-Based: Physical demand from jewellery markets, particularly India and China, continues alongside macro-driven investment flows. Central bank purchases remain steady and relatively insensitive to price levels, while technology-related usage provides an additional, stable layer of demand.

- Policy-Driven Volatility Emerges: Short-term pressure surfaced after U.S. President Donald Trump nominated Kevin Warsh as the next Federal Reserve Chair, raising expectations of a potentially firmer policy approach once Jerome Powell completes his term in May.

Gold Overview

Since mid-2024, gold has remained among the strongest-performing precious metals, navigating shifting macro conditions while maintaining its appeal as a monetary hedge. On 02 February 2026, spot prices slipped 4.31% to USD 4,654.86 amid hawkish policy speculation, reflecting elevated volatility rather than a fundamental breakdown. Despite this pullback, gold is still on course for its strongest annual performance since 2024, with geopolitical and economic uncertainty continuing to provide underlying support.

Volatility Picks Up After Record Highs

Following its move to fresh all-time highs, gold prices retreated during early Asian trading after a sharp selloff driven by profit-taking, renewed strength in the U.S. dollar index, and policy-related uncertainty. After touching levels near USD 5,602.75 and gaining roughly 121.50% since mid-2024, prices fell more than 10% in a single session as volatility intensified. The decline coincided with the Fed leadership announcement and a rebound in the dollar, prompting investors to reassess near-term positioning.

Technical View: Price Momentum Cools After Sharp Decline

From a technical standpoint, spot gold is trading below its 21-day Simple Moving Average at USD 4,766.60, which now acts as immediate overhead pressure. The 50-day Simple Moving Average near USD 4,482.57 continues to provide broader structural support. Momentum has softened following the sharp one-day drop, reflecting aggressive profit-booking. The 14-day RSI has eased to 46.82 after retreating from elevated levels, pointing to moderating momentum. On the downside, support is located near USD 4,400.00 and USD 3,800.00, while resistance is seen around USD 4,900.00 and USD 5,500.00.

Bottom Line: Gold at a Crossroads After a Historic Run?

After an exceptional two-year advance, gold appears to be entering a phase of reassessment rather than a decisive trend change. While short-term momentum has cooled amid policy uncertainty and profit-taking, the broader structure remains supported by steady central bank demand and ongoing geopolitical risks. A period of consolidation looks likely as markets recalibrate expectations following gold’s historic run.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.