Source: shutterstock

The Indian defense sector has been an area of significant growth and development over the past few years. With an increasingly complex security landscape, India has ramped up its defense spending, aiming to modernize its armed forces and bolster national security. The sector has witnessed considerable attention from both the government and private players, fostering opportunities for investments, including in publicly traded companies listed on the National Stock Exchange (NSE).

Key Drivers of Growth in the Indian Defense Sector

The Indian government’s defense strategy has focused on reducing dependence on foreign suppliers and boosting indigenous manufacturing capabilities. The Atmanirbhar Bharat (Self-Reliant India) initiative, launched by Prime Minister Narendra Modi, is central to this ambition, aiming to enhance domestic production and reduce imports. This strategy is not only aimed at building a robust defense industry but also encouraging private players to enter the sector.

The Union Budget 2024-25 allocated ₹5.94 lakh crore to defense, marking a 13% increase over the previous year. This allocation includes ₹1.62 lakh crore for capital outlay, which funds modernization efforts such as procuring advanced weapons systems, upgrading military equipment, and bolstering infrastructure for the armed forces. The emphasis on modernizing the Indian Army, Navy, and Air Force underlines the government's commitment to enhancing operational readiness.

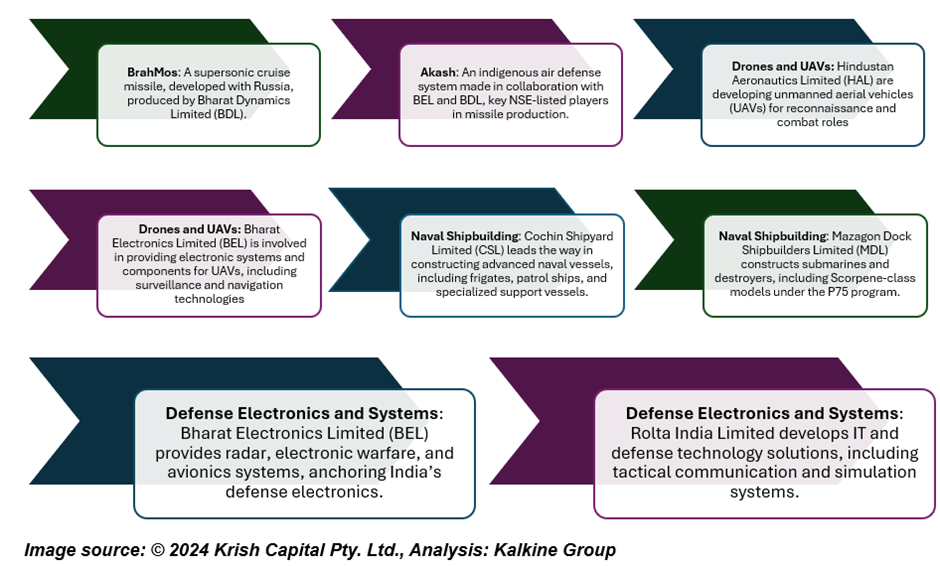

Defending the Nation: Key Achievements of India’s Publicly Listed Defense Giants

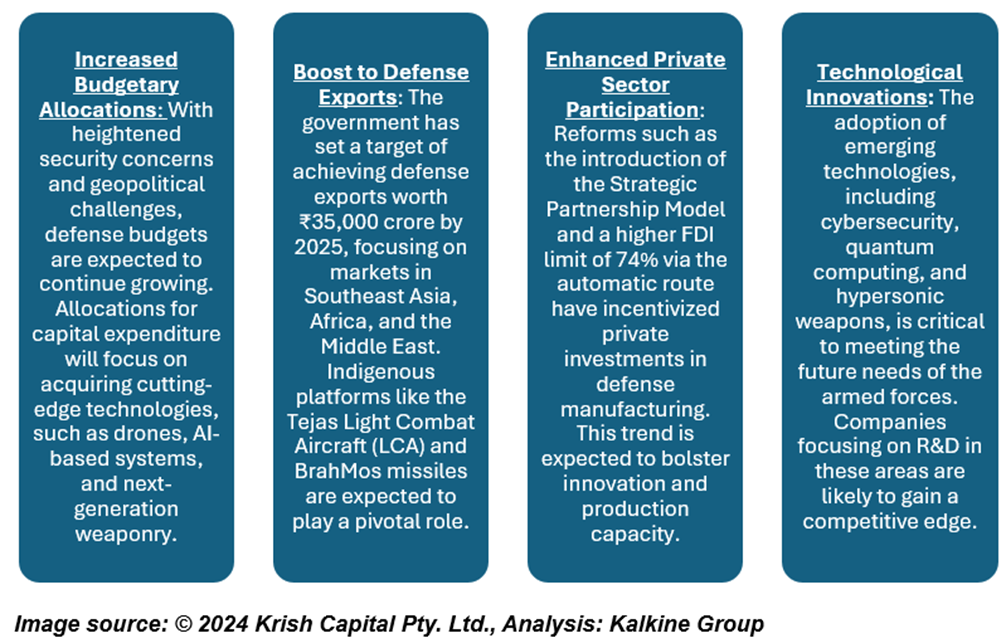

Expectations from the Indian Defense Sector

The Indian government has set ambitious goals for the defense sector, driven by the need for greater self-reliance and technological advancements. Key expectations include:

Stock Analysis

Bharat Dynamics Limited (NSE: BDL) shows bearish momentum with a sharp price decline. Key support levels are ₹1000 and ₹800, while resistance is at ₹1300 and ₹1400-₹1500. The RSI at 39.20 indicates bearishness but is not oversold. The short-term trend is bearish, the medium-term is range-bound between ₹1000 and ₹1300, and the long-term trend stays bullish above ₹1000. The stock was trading at ₹1,108.05 as at the closing of 30 Dec'2024.

Hindustan Aeronautics Limited (NSE: HAL) suggests bearish momentum with a recent decline in price. The key support levels are around ₹4000, where the price may find stability, and ₹3500, a stronger historical support zone. On the resistance side, ₹4500 appears to be a significant hurdle, while ₹5000 serves as a higher resistance level observed in the past. The RSI stands at 30.47, indicating the stock is nearing oversold territory. This could signal a potential reversal if buyers return. The short-term trend is bearish, with the price weakening consistently. The medium-term shows consolidation within the ₹4000–₹4500 range, and the long-term trend remains intact as long as the stock sustains above the ₹3500 support. The stock was trading at ₹4,081.05 as at the closing of 30 Dec'2024.

Investment Potential and Challenges

Investing in defense stocks can be attractive, given the sector's growth prospects. However, investors should be mindful of challenges such as government policy changes, regulatory hurdles, and the cyclical nature of defense procurement. Additionally, some defense companies, particularly state-owned entities, may face constraints due to bureaucratic processes and budgetary limitations.

Despite these challenges, the defense sector presents a unique opportunity, with both the public and private sectors aligning to make India a global defense powerhouse.

Outlook for the Indian Defense Industry

Conclusion

The Indian defense sector is poised for growth, driven by initiatives like Atmanirbhar Bharat and increased defense spending of ₹5.94 lakh crore in the 2024-25 budget. The focus on indigenous manufacturing and modernization of the armed forces creates investment opportunities in key players like Bharat Dynamics Limited (BDL) and Hindustan Aeronautics Limited (HAL). While BDL and HAL exhibit bearish trends currently, their long-term potential remains tied to India's push for self-reliance. Investors should weigh opportunities against challenges such as policy shifts, budgetary limitations, and regulatory hurdles, as the sector continues to evolve toward making India a global defense leader.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.