IHCL Delivers Robust Q1FY26 Results Amid Operational Headwinds

Source: shutterstock

The Indian Hotels Company Limited (IHCL) reported a resilient performance in the first quarter of FY26, marking its 13th consecutive quarter of record earnings. Despite facing operational disruptions including geopolitical tensions, flight cancellations, and Operation Sindoor, the company demonstrated its ability to maintain growth through its diversified portfolio, strong brand equity, and disciplined execution.

Financial Performance with Broad-Based Growth

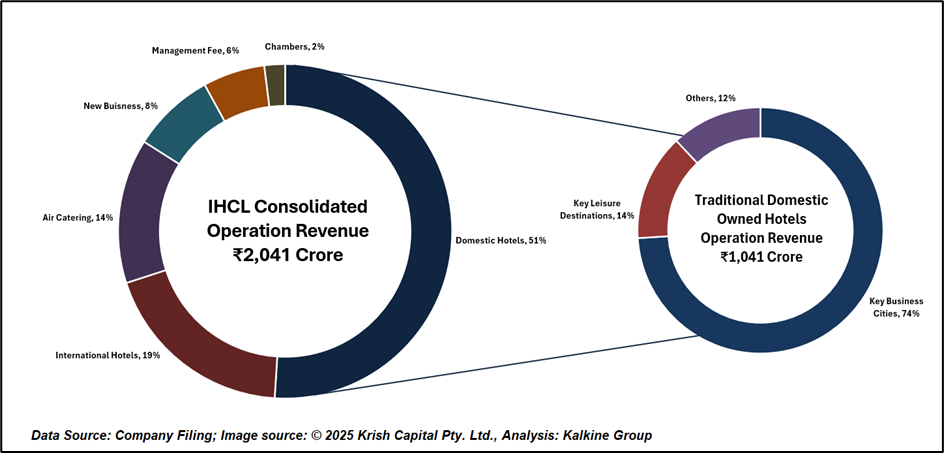

In the first quarter of FY26, IHCL reported consolidated revenue of ₹2,102 crore, marking a 32% increase compared to the corresponding period of the previous year. The company’s EBITDA climbed 29% to reach ₹637 crore, while net profit stood at ₹296 crore, reflecting a 19% year-on-year rise. Although the EBITDA margin saw a slight dip of 70 basis points, settling at 30.3%, IHCL maintained robust operational efficiency by effectively managing costs and upholding strong operational discipline.

The hotel segment, which includes both domestic and international operations, contributed ₹1,814 crore in revenue, up 14% YoY, while the air catering business (TajSATS) reported a revenue increase of 21% YoY to ₹290 crore.

Operational Metrics Reflect Market Resilience

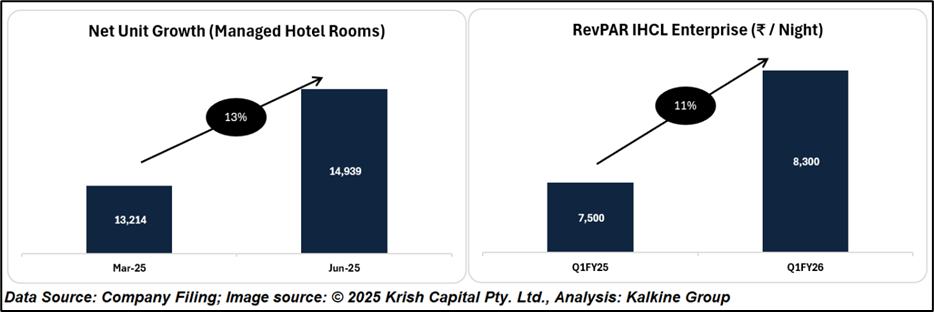

IHCL's performance was sustained by healthy trip demand across crucial business and rest destinations. Revenue per available room (RevPAR) witnessed double-digit growth across domestic and international portfolios. Domestic traditional hotels registered RevPAR growth of 11%, while international operations saw a 13% YoY increase, supported by both occupancy and average rate improvements.

Despite an estimated 2% to 2.5% revenue impact from external disruptions, IHCL sustained its growth trajectory, further validating the resilience of its operations.

Portfolio Expansion and Brand Diversification

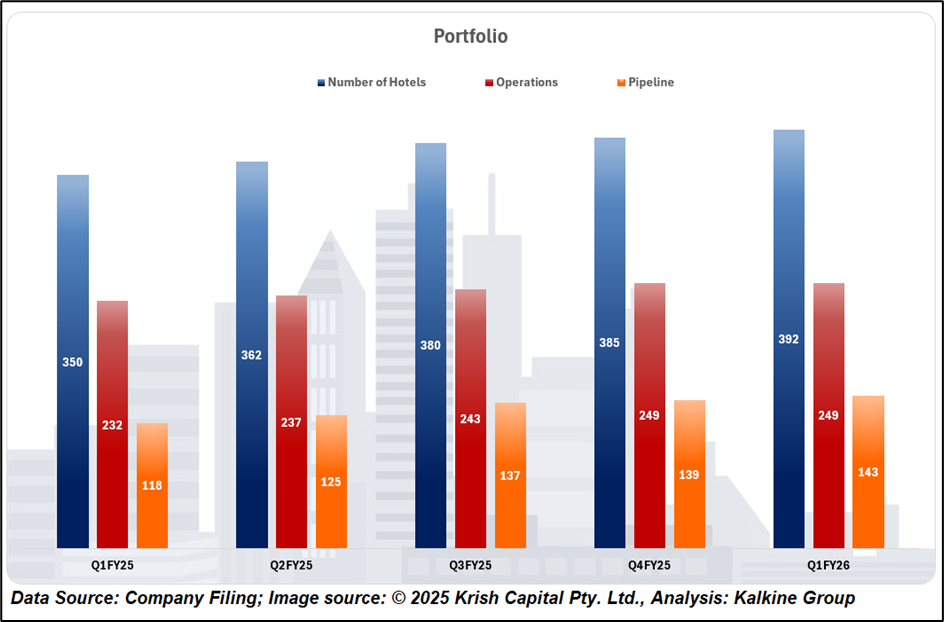

During the quarter, IHCL opened six new hotels and added 12 signings to its growing pipeline. As of June 30, 2025, the portfolio stood at 392 hotels, comprising 249 operational properties and 143 under development. Notable openings included Taj Alibaug, Claridges in Delhi, and Ginger Dehradun.

The company reiterated its target to open 30 new hotels in FY26, translating into 3,000–3,500 new keys, of which approximately 600 will be balance sheet assets.

IHCL continues to expand through an asset-light strategy, reflected in a 17% YoY increase in management fees, and strengthening its diversified brandscape across the luxury, upscale, and lean-luxury segments.

Outlook: Sustained Confidence in Double-Digit Growth

Despite a high base in Q2FY25, the management remains optimistic about delivering double-digit revenue growth for FY26. Key drivers include the opening of marquee properties such as the Navi Mumbai Airport hotel in Q3FY26, multiple high-profile MICE events, and limited room supply in key business cities, which is expected to support pricing and occupancy.

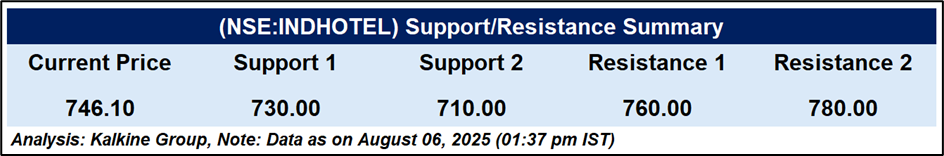

Technical Summary

The stock is currently trading below its 51-day Exponential Moving Average of ₹756.23, indicating weak short-term momentum. The Relative Strength Index (RSI) is at 46.87, suggesting a neutral to slightly bearish sentiment. The price action remains largely range-bound, with resistance seen near ₹760 and support around ₹730. Breaking above ₹760 could open up further upside potential, while falling below ₹730 may lead to additional downside risk. Overall, the stock appears to be consolidating, with a cautious market tone.

Conclusion

IHCL’s Q1FY26 results highlight its resilience and disciplined execution amid operational challenges. Continued portfolio expansion, healthy demand, and margin stability reinforce long-term growth visibility. While fundamentals remain positive, near-term stock action may stay range-bound unless it breaks decisively above resistance, offering limited upside in the immediate term.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.