India’s Car Market Sees Record Single-Day Sales Amid Festive Season and GST 2.0 Revisions

Source: shutterstock

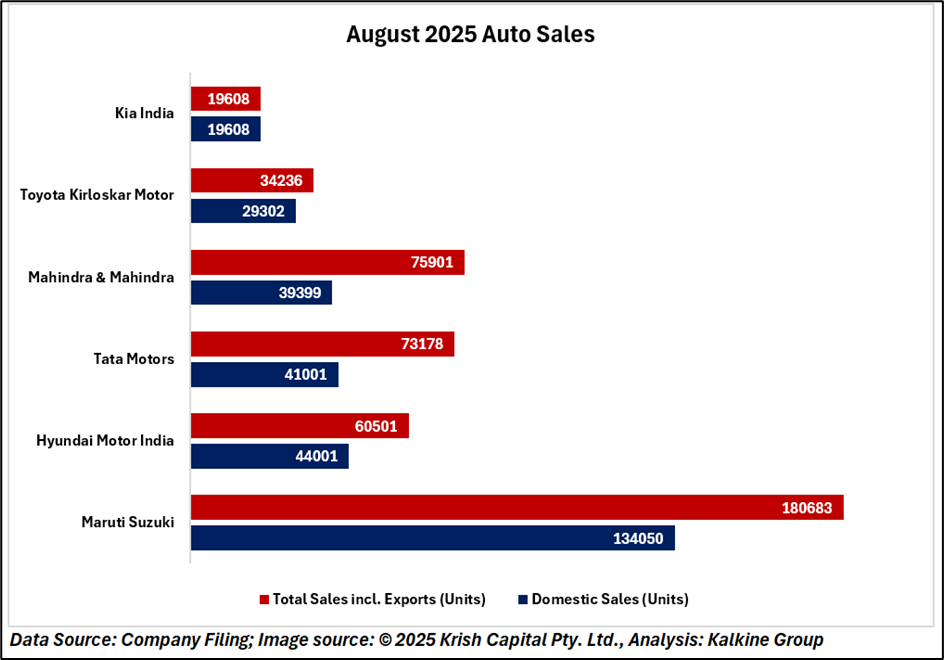

India’s automobile sector witnessed an unprecedented spike in sales on 22 September 2025, fueled by the ongoing Navratri festivities, the approaching Diwali season, and the implementation of GST 2.0 price revisions. Leading manufacturers including Maruti Suzuki, Hyundai, and Tata Motors reported exceptional delivery volumes, while pre-owned car platforms also recorded heightened activity, signaling strong consumer sentiment.

Maruti Suzuki Leads with 30,000 Units in a Single Day

Maruti Suzuki emerged as the front-runner during this surge, delivering 30,000 vehicles far exceeding its typical daily average of 5,000–6,000 units. Following price revisions on 18 September, the company had been booking approximately 15,000 cars per day. The brand also received over 80,000 enquiries, with entry-level models such as the Alto K10 and WagonR driving the highest demand.

Hyundai and Tata Motors Ride the Wave of Festive Demand

Hyundai reported deliveries of 11,000 units on the same day, marking its best single-day performance in five years. Tata Motors completed 10,000 deliveries, complemented by around 25,000 customer enquiries. Analysts note that reduced GST rates and updated pricing were key drivers behind the surge, alongside the heightened festive buying sentiment.

Festive Season Catalyzes Vehicle Purchases

With Navratri celebrations in full swing and Diwali approaching, buyers are responding positively to the combination of lower GST rates and revised pricing. Dealerships across Delhi, Gurugram, Mumbai, and smaller towns reported three to five times their usual Monday deliveries, highlighting the festival-driven uplift in consumer demand. Pre-owned car platforms also saw multi-year highs in inspections and deliveries, reflecting broader market enthusiasm.

Dealerships Report Exceptional Footfall

Dealers in metropolitan areas and tier-2 towns alike experienced unusually high customer footfall, with many reporting record-breaking deliveries during the festive period. This surge reflects both cultural purchasing patterns and the strategic timing of GST 2.0 price adjustments, which have incentivized early bookings.

Technical Analysis

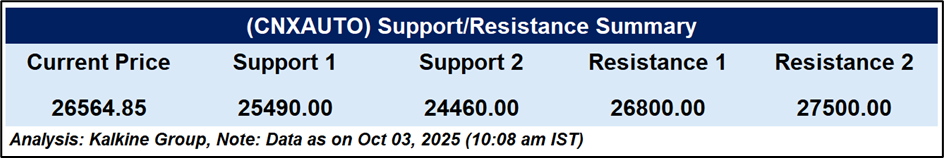

The Nifty Auto Index is trading at 26,564.85, down about 0.76% intraday. It remains above the 51-day EMA (25,731), showing ongoing medium-term strength. The RSI at 53 reflects easing momentum from recent peaks. Key support lies near 25,490, while a sustained push above 26,800 may re-energize bullish sentiment.

Conclusion

India’s automobile sector is experiencing a historic upswing, driven by festive season demand, GST 2.0 revisions, and strong consumer sentiment. Record-breaking sales from Maruti, Hyundai, and Tata highlight robust market momentum. With technical showing resilience, the sector is well-positioned for continued growth through the festive season and beyond.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.