IndusInd Bank Q1FY26 Profit Slumps 72% YoY Amid Margin Pressure and Asset Quality Strain

Source: shutterstock

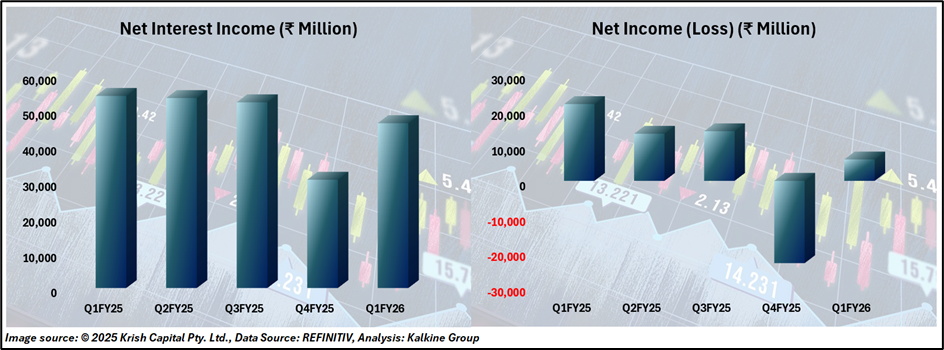

IndusInd Bank Limited posted a consolidated net profit of ₹604 crore for Q1FY26, down 72% year-on-year from ₹2,171 crore in the same quarter last year (Q1FY25). The decline in profitability comes amid a sharp drop in net interest income (NII), lower fee-based income, and a contraction in net interest margin (NIM).

Financial Performance

The Bank’s NII fell 14% YoY to ₹4,640 crore in Q1FY26, down from ₹5,408 crore a year earlier. This was accompanied by a reduction in NIM to 3.46%, compared to 4.25% in the corresponding period last year. Total income, comprising interest and fee-based earnings, dropped to ₹14,421 crore in Q1FY26 from ₹14,988 crore in the same quarter last year. Pre-provision operating profit (PPOP) also saw a significant decline to ₹2,568 crore from ₹3,952 crore in Q1FY25.

Operating expenses rose to ₹4,229 crore, up from ₹3,897 crore a year ago, while the cost of funds edged up slightly to 5.69% from 5.62%. Despite the pressure on margins, the bank maintained adequate provisioning, with provisions and contingencies amounting to ₹1,760 crore in the quarter, down from ₹2,522 crore in the previous quarter.

The bank’s gross non-performing assets (GNPA) ratio increased to 3.64% from 3.13% sequentially, and the net NPA ratio rose to 1.12% from 0.95%. Nonetheless, capital adequacy remained strong, with CRAR at 16.63% (excluding Q1FY26 profit) and Tier 1 capital at 15.48%. Total risk-weighted assets grew to ₹4,09,810 crore from ₹3,88,838 crore YoY.

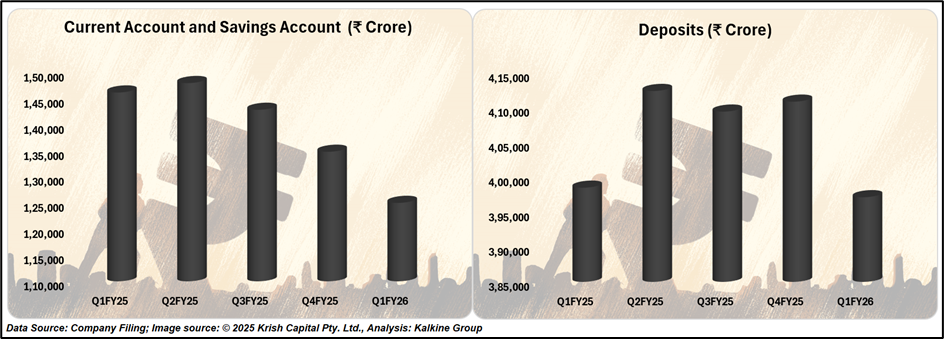

As of June 30, 2025, IndusInd Bank’s balance sheet stood at ₹5,39,552 crore, reflecting a modest 2% year-on-year increase. Deposits were ₹3,97,144 crore, down slightly from ₹3,98,513 crore in Q1FY25, with CASA (current and savings accounts) deposits comprising 31.48% of total deposits. Advances also declined to ₹3,33,694 crore from ₹3,47,898 crore in the prior year.

Company Outlook

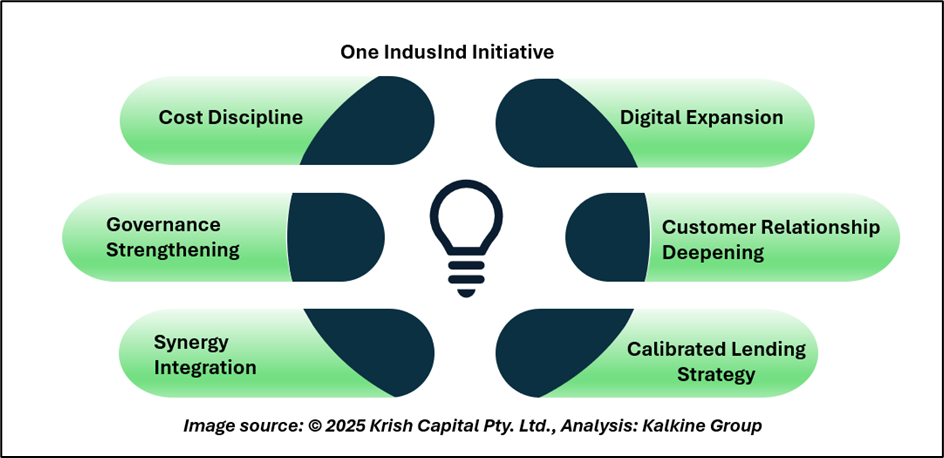

Management acknowledged the challenges during the quarter but emphasized that the bank is on a path of steady recovery. The leadership transition is progressing, with final recommendations submitted to the regulator. The interim executive committee continues to drive operational continuity and strategic execution. Under the ‘One IndusInd’ initiative, the bank is working to integrate business verticals, improve synergies, and enhance efficiency. Key priorities include cost discipline, stronger governance, and operational controls. Liquidity remains robust with an average LCR of 141%, supporting resilience amid market uncertainties.

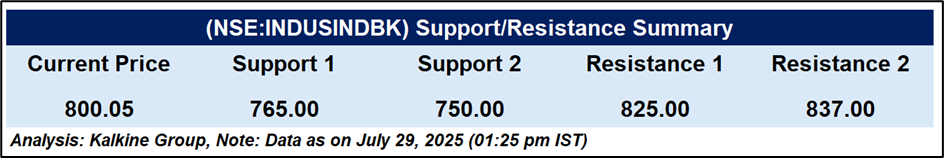

Technical analysis

IndusInd Bank Ltd is currently trading at ₹800.05, below its 51-day EMA of ₹837.81, reflecting a bearish undertone. The stock has broken out of its consolidation range of ₹825–₹835 and is now forming a pattern of lower highs and lower lows. The RSI stands at 34.57, close to the oversold zone, which may suggest a potential short-term rebound. However, the overall momentum remains subdued. Immediate support is placed at ₹790; a break below this could lead to further declines toward the ₹765–₹750 range.

Conclusion

IndusInd Bank faces near-term pressure amid a sharp profit decline, weak margins, and rising NPAs. While management highlights strategic reforms and liquidity strength, operational challenges persist. Technically, the stock remains bearish below key moving averages. Sustained recovery will depend on improved earnings visibility, cost control, and stabilization of asset quality.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.