KEC International Gains Spotlight with ₹3,243 Crore Order Win

Source: shutterstock

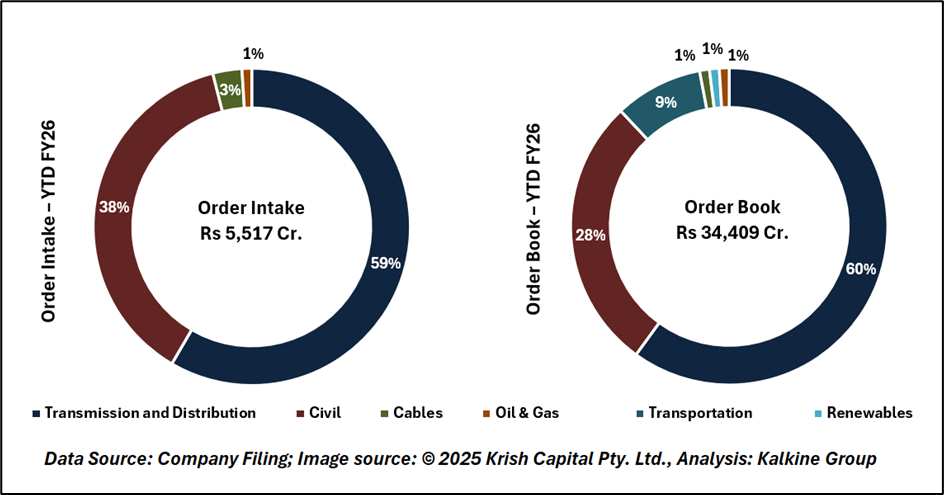

KEC International Ltd., a global infrastructure engineering, procurement, and construction (EPC) major, is set to remain in market focus after announcing fresh orders worth ₹3,243 crore. The contracts have been bagged under its transmission and distribution (T&D) business, further strengthening its already robust order book.

According to the company’s release, the latest wins include 400 kV transmission line projects in the United Arab Emirates (UAE) as well as the supply of towers, hardware, and poles in the Americas. These projects reaffirm KEC’s strong international presence and execution capabilities across key geographies.

The development adds to the company’s recent momentum in securing large-scale contracts. In August 2025, KEC announced new orders worth ₹1,402 crore, while in July 2025, it secured ₹1,509 crore across multiple business segments. The latest deal marks one of the largest wins this fiscal year and reflects rising demand for transmission infrastructure amid global energy transition and grid modernization efforts.

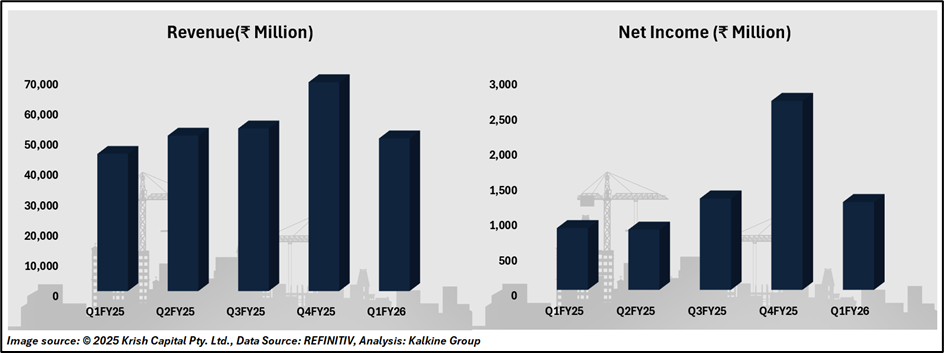

With a diversified presence across over 100 countries, KEC International has built a strong reputation in T&D, railways, civil construction, and cables. The consistent flow of orders signals a healthy outlook for its revenue visibility in FY26.

KEC International surged 6.9% in morning trade on 23 September 2025, as investors reacted positively to its ₹3,243 crore order inflow. The development is seen bolstering earnings visibility and supporting margin sustainability. Analysts highlight strong traction in international markets, which could further strengthen KEC’s long-term growth trajectory, keeping the stock in sharp investor focus.

Technical Analysis

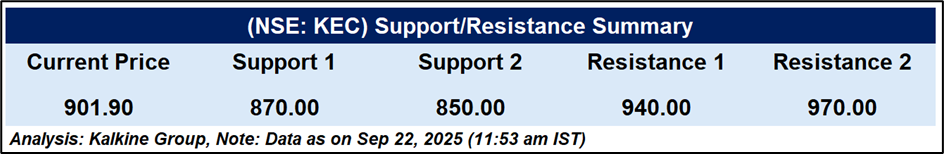

KEC International is currently trading around ₹901.90, up over ~4%, with strong volumes. The stock has moved above its 51-day EMA at ₹853, indicating renewed bullish momentum. RSI at 64.6 signals strength but is nearing overbought levels. Key resistance is seen at ₹940, while support lies at ₹870–850. Sustained buying may extend the rally.

Conclusion

KEC International’s latest ₹3,243 crore order win reinforces its strong global positioning in T&D and underpins robust revenue visibility for FY26. With improving international traction, steady order inflows, and positive technical signals, the stock remains well-placed for further upside, though investors should watch resistance near ₹940.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.