Nykaa Reports Strong Q1 FY26 Performance as Revenue, Profit Surge, Stock Climbs

Source: shutterstock

FSN E-Commerce Ventures Limited (“Nykaa”), India’s leading beauty and lifestyle retailer, announced its Q1FY26 financial results, with its stock gaining approximately 5%.

Financial Performance

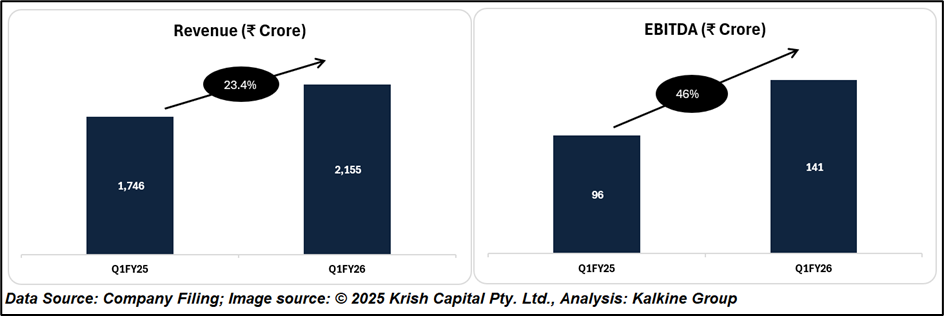

The company reported a 23% year-on-year (YoY) increase in revenue from operations to ₹2,155 crore, compared to ₹1,746 crore in Q1 FY25. Gross profit rose by 27% YoY to ₹962 crore, with gross margins improving by 132 basis points to 44.6%, reflecting a favourable product mix and operational efficiencies.

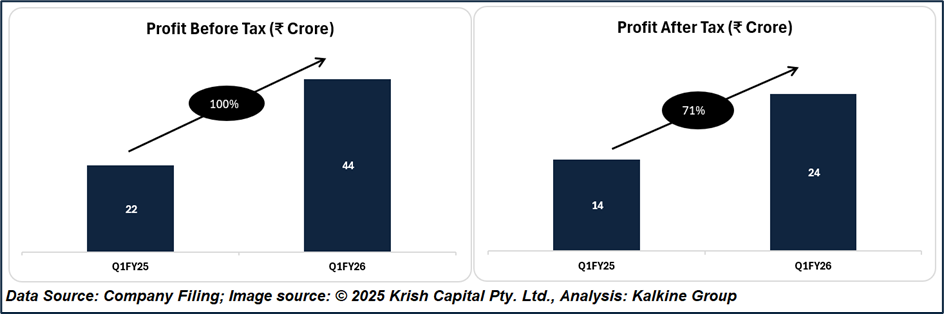

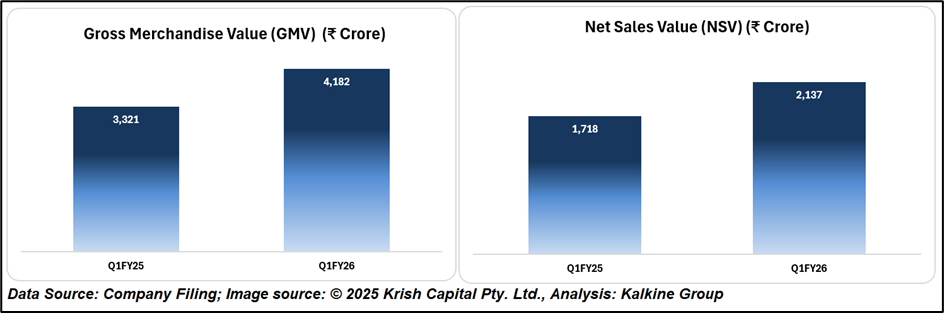

Earnings before interest, tax, depreciation, and amortisation (EBITDA) stood at ₹141 crore, representing a 46% YoY increase, with EBITDA margins expanding to 6.5% from 5.5% in the prior year. Profit after tax (PAT) surged 79% YoY to ₹24 crore, with the PAT margin improving to 1.1%, driven by higher contribution from owned brands, increased visibility income, and cost optimisation measures. Gross Merchandise Value (GMV) stood at ₹4,182 crore, marking a 26% year-on-year increase, with both the beauty and fashion segments recording 25% growth each.

In the beauty segment, Net Sales Value (NSV) rose 25% YoY to ₹1,834 crore, supported by premiumisation, strong global and domestic brand launches, and an expanded retail footprint of 250 beauty stores across 82 cities. The fashion segment recorded NSV of ₹294 crore, up 20% YoY, with EBITDA margin improving to -6.2% from -9.2% last year, aided by a revival in core platform growth, expanded assortment, and strong customer acquisition. The company’s “House of Nykaa” portfolio achieved a ₹2,700 crore annualised GMV run rate, growing 57% YoY, led by flagship brands such as Dot & Key, Nykaa Cosmetics, and Kay Beauty.

Operational Metrics

Nykaa’s customer base expanded to over 45 million, marking a 30% YoY increase. The company now offers over 9,000 brands on its platform, with more than 400 launched during the quarter. Rapid delivery capabilities were strengthened through a network of over 50 rapid stores in seven cities, enabling delivery within 30–120 minutes in select locations. Notably, Dot & Key achieved a ₹1,500 crore GMV run rate with high-teens EBITDA margins and strong customer retention rates.

Strategic Developments

Nykaa announced during the quarter that it will acquire the remaining 40% stake in Nudge Wellness, thereby taking full ownership of the company. This acquisition aligns with the company’s strategy to tap into India’s growing beauty supplements market, which is expected to reach $11 billion by FY28 at an estimated CAGR of 11%. Additionally, Kay Beauty is set to make its international debut in the United Kingdom through an exclusive partnership with Space NK, becoming the first India-founded beauty brand in the retailer’s portfolio.

Technical Analysis

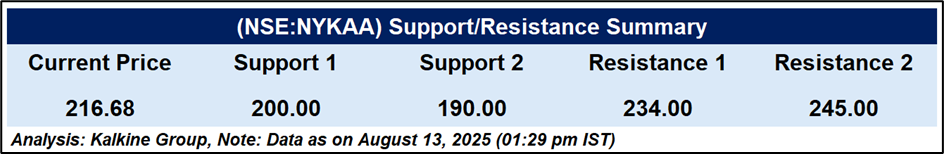

FSN E-Commerce Ventures Limited (NSE: NYKAA) is currently trading at ₹216.68, up 5.88%. The price is above its 51-day EMA of ₹206.60, indicating short-term bullish sentiment. It is testing a key long-term descending trendline horizontal resistance near ₹220, with immediate support at ₹200 and secondary support at ₹190. The RSI at 57.72 signals improving momentum while remaining below overbought levels. A breakout above ₹220 could open an upside potential toward ₹234–₹245, whereas rejection at this level may prompt a pullback to the ₹206 zone.

Conclusion

Nykaa delivered a strong Q1 FY26 with double-digit growth in revenue, profit, and GMV, supported by premiumisation, brand expansion, and operational efficiency. With positive market sentiment, strategic acquisitions, and international forays, the company is well-positioned to sustain momentum and capture growth opportunities in India’s beauty, fashion, and wellness segments.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.