Paytm Hits 52-Week High as Q1 FY26 Marks Profitability Milestone

Source: shutterstock

One 97 Communications Limited (NSE: PAYTM) touched its 52-week high on August 20, 2025, following a landmark Q1 FY26 performance that marked profitability across all major financial metrics and reaffirmed its leadership in India’s merchant payments ecosystem. The company’s results for the quarter ended June 30, 2025, underscore strong revenue momentum and the increasing benefits of its AI-driven operating leverage.

Financial Performance

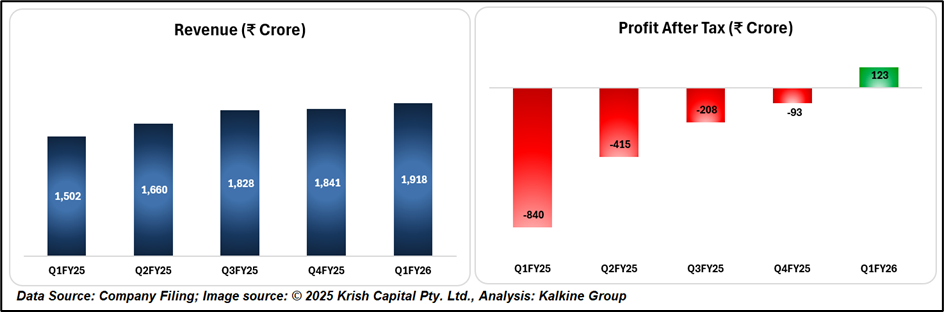

Paytm reported operating revenue of ₹1,918 crore, marking a 28% year-on-year increase, driven by higher gross merchandise value (GMV), expansion in subscription merchants, and growth in financial services distribution revenue. Contribution profit rose 52% YoY to ₹1,151 crore, translating into a 60% contribution margin, reflecting improved payment economics, cost discipline, and an increasing share of high-margin financial services revenue.

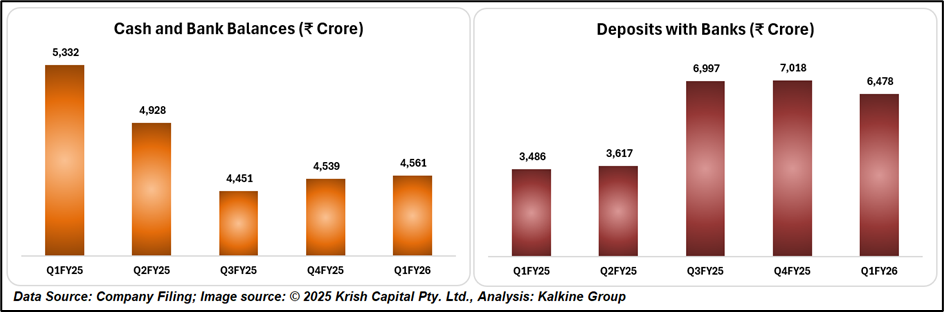

For the first time, both EBITDA and PAT turned positive, with EBITDA at ₹72 crore (4% margin) and Profit After Tax at ₹123 crore. The turnaround underscores the company’s sharper focus on profitability, aided by a disciplined cost structure and higher other income. Paytm closed the quarter with a robust cash balance of ₹12,872 crore, providing significant flexibility for future investments and expansion.

Merchant Payments: Core Growth Engine

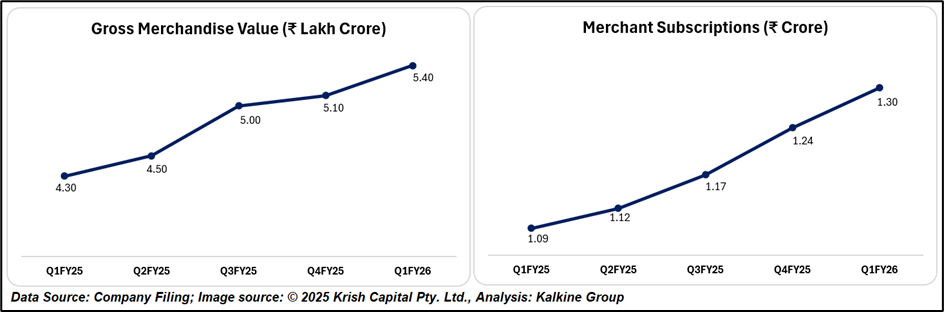

Paytm continues to consolidate its leadership in India’s merchant payments landscape, with subscription merchants reaching an all-time high of 1.30 crore, up 21 lakh over the past year. Net payment revenue surged 38% YoY to ₹529 crore, supported by higher payment processing margins and wider adoption of devices such as Soundbox and All-in-One POS terminals.

GMV rose 27% YoY to ₹5.39 lakh crore, while average monthly transacting users (MTUs) stood at 7.4 crore, reflecting sustained consumer engagement. Importantly, Paytm’s merchant monetization funnel has expanded, with stronger retention and increased cross-selling opportunities through loan distribution and value-added services.

Distribution of Financial Services: Rapid Expansion

The company’s financial services distribution business doubled its revenue to ₹561 crore, driven by strong growth in merchant loans, improved collections, and sustained partner interest. More than 5.6 lakh merchants and consumers availed loans, insurance, and broking services via Paytm during the quarter. Notably, a growing share of disbursements shifted to the non-DLG (Default Loss Guarantee) model, improving asset quality and lowering upfront costs.

Technical Analysis

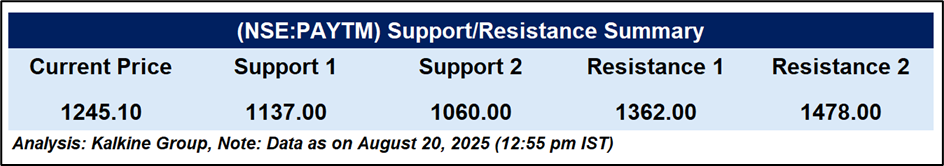

One 97 Communications Ltd (NSE: PAYTM) is trading at ₹1,245.10 (+1.54%), having touched a 52-week high on August 20, 2025. The price is positioned above the 51-day EMA of ₹1,027.32, indicating ongoing upward momentum. The RSI (14) at 80.92 reflects overbought conditions, which may lead to short-term consolidation or mild profit-taking. Immediate support levels are placed at ₹1,137 and ₹1,060, while resistance levels are seen at ₹1,362 and ₹1,478. A move beyond these resistance levels could extend the current trend, while pullbacks may retest key supports.

Conclusion

Paytm’s Q1 FY26 results highlight a decisive shift toward sustainable profitability, supported by expanding merchant payments, financial services growth, and AI-driven efficiencies. While technical indicators suggest potential short-term consolidation, the company’s strong fundamentals, robust cash position, and expanding ecosystem position it well for long-term value creation.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.