Piramal Pharma Q3FY26 Results: Revenue Down 3% | Recovery Ahead?

Source: shutterstock

Piramal Pharma Limited reported consolidated revenue from operations of INR 2,140 crore for Q3FY26, down 3% year-on-year, while 9M FY26 revenue declined 4% to INR 6,117 crore. The moderation was primarily linked to inventory destocking by a customer for a large on-patent product, slower early-stage CDMO order inflows during H1FY26, and regulatory delays affecting inhalation anesthesia supplies from the Digwal facility to non-US markets.

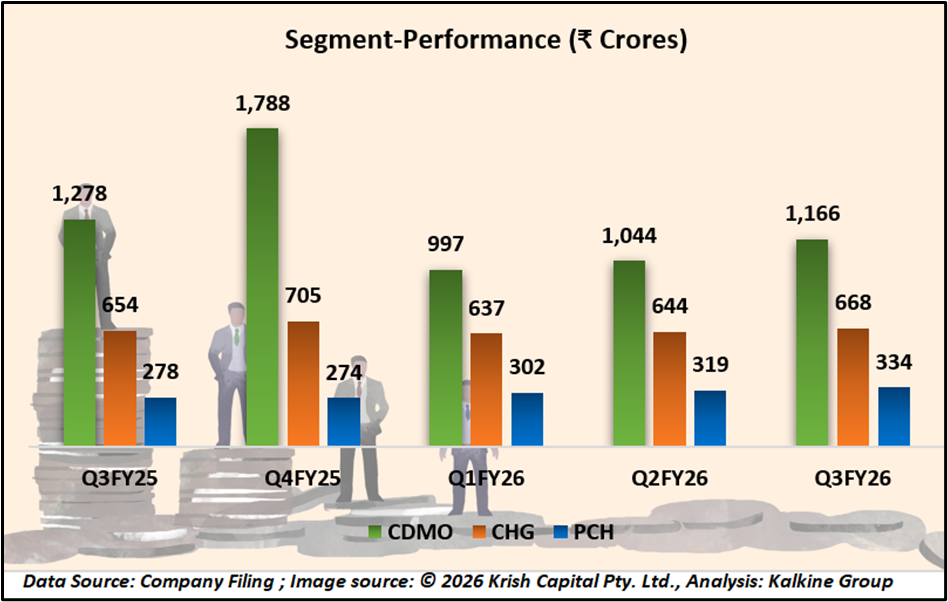

Segment-Wise

Segment-wise, Contract Development and Manufacturing Organization (CDMO) revenue declined 9% in Q3FY26 and 12% over nine months, reflecting cautious spending by global biopharma clients. Complex Hospital Generics (CHG) recorded marginal growth, while Piramal Consumer Healthcare (PCH) posted double-digit growth, driven by power brands and higher e-commerce contribution.

CDMO Order Flow Shows Tentative Improvement

Management indicated a noticeable improvement in RFP activity and order inflows from October 2025, supported by higher biopharma funding and increased M&A activity in the US healthcare sector. Overseas CDMO facilities with differentiated capabilities continued to see stable inquiry levels. Ongoing capex of USD 90 Mn for Lexington and Riverview expansions remains on track.

Consumer and Hospital Segments Hold Ground

Consumer Healthcare revenue benefited from new launches, media investments, and faster growth in e-commerce, including quick commerce channels. In CHG, market share gains in inhalation anesthesia and normalization of intrathecal therapy supplies supported stability, although regulatory delays weighed on ex-US growth.

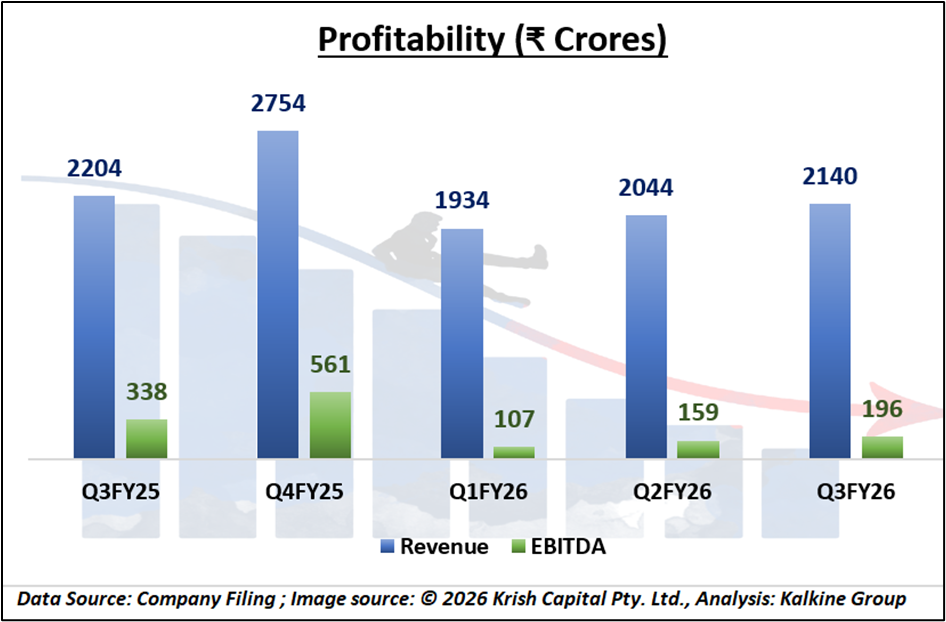

Profitability and Margin Movement

EBITDA for Q3FY26 declined 32% year-on-year to INR 239 crore, with margins contracting to 11% from 16% last year. For 9M FY26, EBITDA stood at INR 628 crore, down 36%. While cost optimization measures helped partially offset revenue pressures, operating leverage remained weak due to lower volumes. The company reported a net loss after exceptional items of INR 136 crore in Q3FY26 and INR 317 crore for 9M FY26.

Broker Consensus Signals Strong Upside with Buy Bias

Analysts maintain a positive view on Piramal Pharma Ltd. assigning a STRONGBUY rating. The consensus target price stands at ₹234.89, implying a potential upside of about 54.1% from current levels. Expectations are supported by the company’s diversified pharmaceutical portfolio, improving earnings visibility, and medium-to-long term growth prospects, even as near-term market volatility persists.

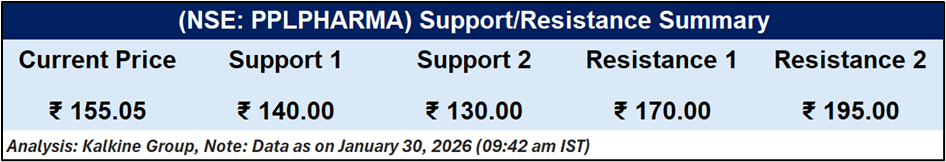

Technical Summary

Piramal Pharma Limited is showing early signs that its downward trend may be stabilising. The stock is currently trading near an important support level around ₹155. However, it remains below the 50-day moving average near ₹173, which indicates the overall trend is still weak and short-term rallies may face selling pressure.

Momentum indicators remain soft, with the RSI close to 33, suggesting the stock is near oversold levels but has not yet shown a clear reversal. On the downside, support is seen at ₹140 and then ₹130. On the upside, resistance is placed near ₹170, with a stronger hurdle around ₹195.

Editorial View

Piramal Pharma’s Q3FY26 results underline near-term stress from a slowing CDMO business and sharp margin contraction, partly offset by resilience in consumer healthcare. Although earnings momentum remains weak, early signs of improving order flows and supportive long-term fundamentals keep recovery hopes alive, contingent on timely execution and demand normalization.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.