PNB Plans ₹5,000 Crore NPA Sale to ARCs, Eyes 50% Recovery Target

Source: shutterstock

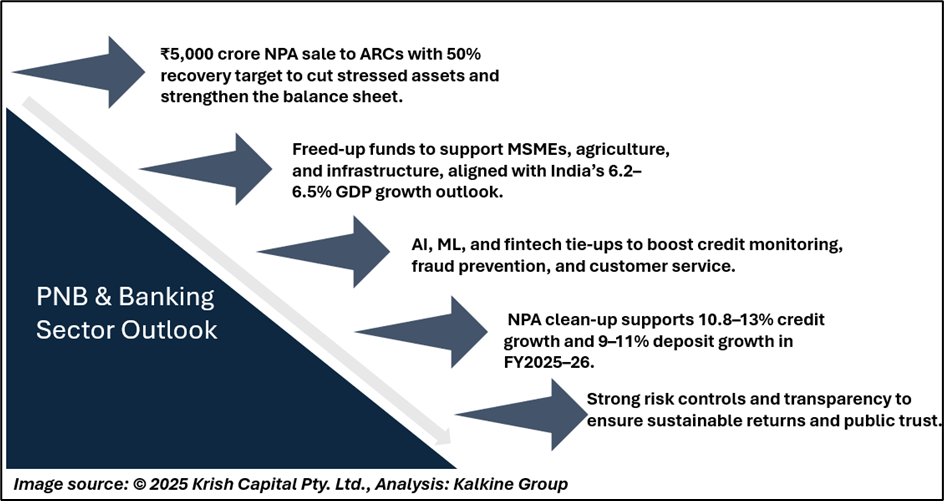

Punjab National Bank (PNB) is preparing to sell non-performing assets (NPAs) worth around ₹5,000 crore to asset reconstruction companies (ARCs) in the current financial year. According to Managing Director Atul Kumar Goel, the bank aims for a minimum realisation rate of 50% from these transactions, signalling a proactive approach to cleaning its balance sheet and improving capital efficiency, while maintaining a sharper focus on core lending operations and future growth opportunities.

ARC Sale Plan

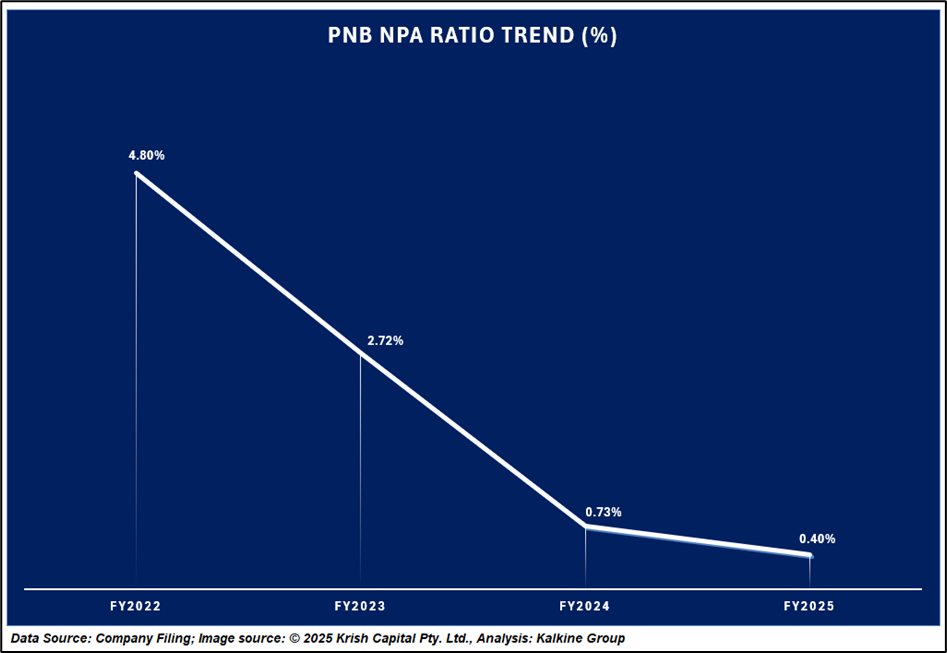

Goel stated that the decision aligns with PNB’s ongoing efforts to strengthen asset quality by reducing its gross NPA ratio. As of March 2025, the lender’s gross NPAs stood at approximately 5.7%, with net NPAs around 1.3%. By transferring stressed loans to ARCs, the bank expects to focus more on lending to viable sectors, reduce provisioning burdens, and free up management bandwidth from protracted recovery processes.

The ₹5,000 crore sale will likely include a mix of corporate, SME, and retail stressed accounts. ARCs are expected to bid competitively for these assets, with PNB retaining the right to accept only those offers meeting the 50% recovery threshold. This strategy seeks to maximise value from bad loans rather than engaging in fire-sale pricing.

Economic Context

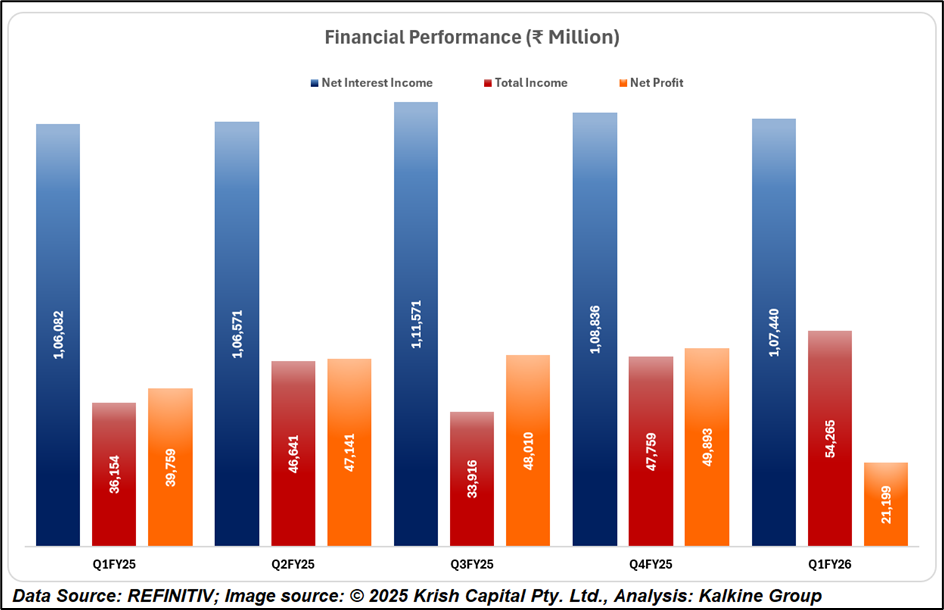

The move comes at a time when India’s banking sector is seeing improved credit growth, with system-wide lending rising in double digits in FY25. However, stressed asset resolution remains a critical factor for sustaining this momentum. NPAs, particularly in the corporate sector, can lock up capital and reduce lending capacity.

By selling to ARCs, PNB not only offloads risk but also recycles capital into productive sectors, contributing to overall economic growth. Faster resolution of bad loans can help improve credit flow to infrastructure, manufacturing, and MSMEs key drivers of India’s GDP expansion. Additionally, the Reserve Bank of India’s (RBI) tightening of provisioning norms has incentivised banks to clear legacy NPAs rather than carry them on their books, which further supports healthy credit distribution and risk management practices.

Challenges and Outlook

While the ₹5,000 crore target is ambitious, the ARC market in India faces its own constraints, such as limited capital availability and slow secondary market activity for security receipts (SRs). Achieving a 50% realisation could be challenging in sectors with weak collateral or in cases of ongoing litigation.

Technical Analysis

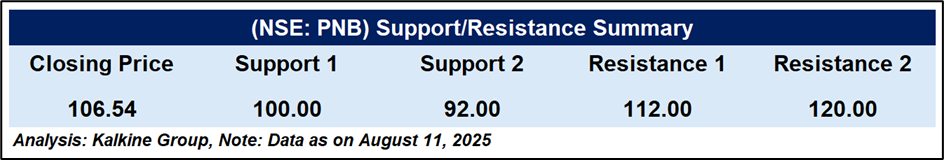

Punjab National Bank is consolidating above the ₹104–₹105 support zone, with long-term trendline support intact. Momentum remains neutral, and sustained trade above ₹100 would preserve structural stability. A breakout above ₹112 may signal renewed upside, while a breach below ₹92 could indicate potential weakening of the long-term trend.

Conclusion

Punjab National Bank’s planned ₹5,000 crore NPA sale reflects a proactive balance sheet cleanup and focus on asset quality. While achieving the 50% recovery target may face market challenges, improving financial metrics and stable technical support zones suggest resilience, with upside potential if key resistance levels are decisively breached.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.