Powering the Future: How India's Data Centre Surge Creates a Multi-Sector Investment Windfall

Source: shutterstock

India’s data centre sector is poised for a significant transformation, with operational capacity expected to almost double to 2,000–2,100 MW by March 2027, as per a report by ICRA. This growth is being driven by rising internet penetration, supportive government policies on data localisation, and surging demand for AI and cloud-based services. The sector is likely to attract investments worth ₹2 to ₹2.3 lakh crore over the next 7 to 10 years.

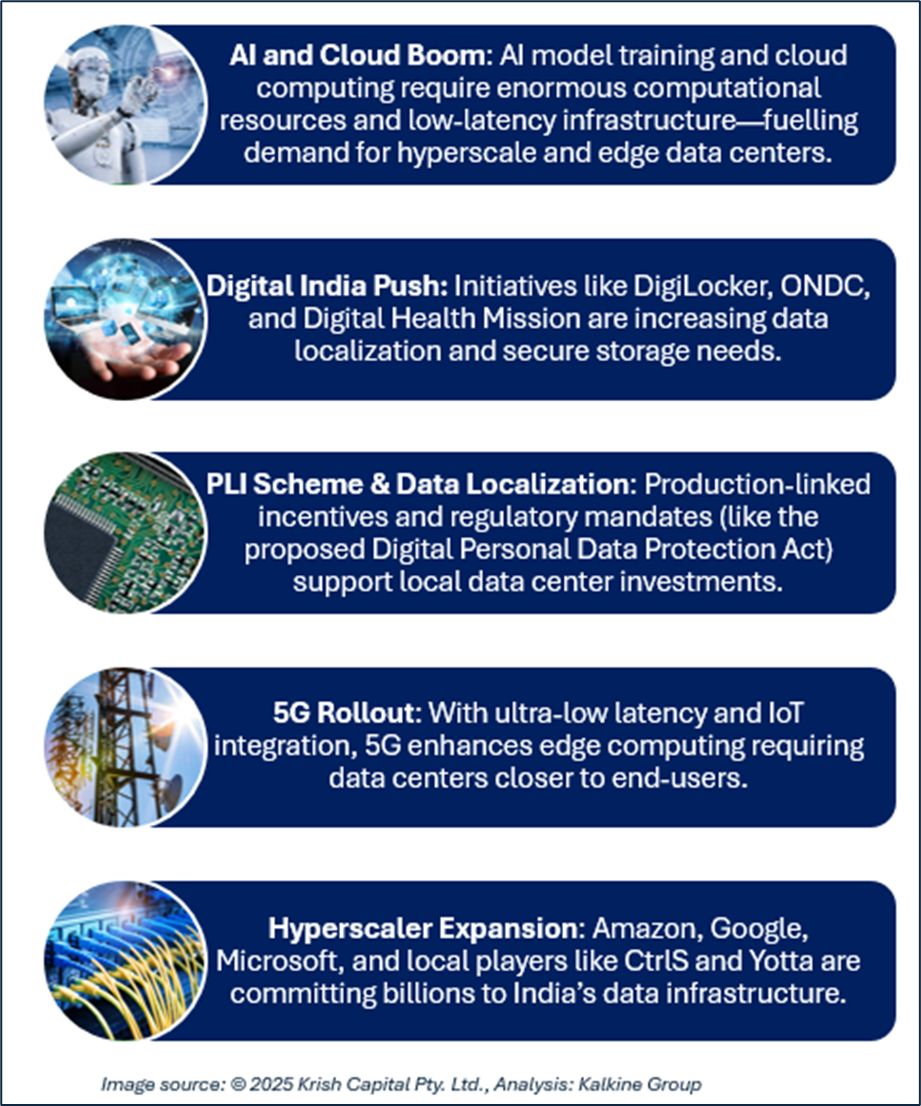

Key Growth Drivers

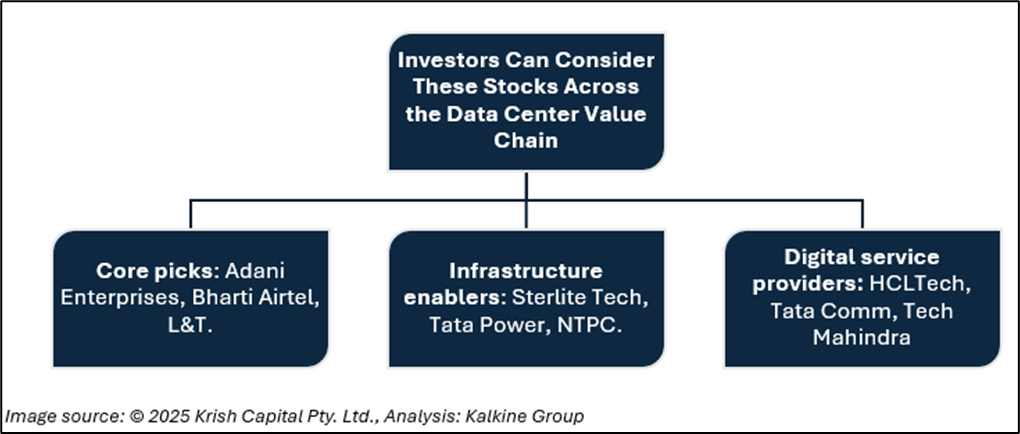

Stocks to Watch: Who Benefits from This Boom?

Real Estate & Infrastructure- These players provide the land and connectivity required for setting up massive data centres.

- DLF Ltd.- Recently partnered with HPE for a green data centre in Chennai. DLF’s commercial real estate arm is expanding into hyperscale-grade facilities.

- Adani Enterprises Ltd.- Through AdaniConneX, it targets 1 GW of data centre capacity across key Indian cities.

- Larsen & Toubro (L&T)- Engineering and construction major that designs and builds data centres across India, including Tier-IV compliant campuses.

Power & Renewable Energy- With energy costs forming ~40–50% of operating expenses for data centres, reliable power supply is critical.

- NTPC Ltd.- India’s leading power producer is stepping into the data centre energy ecosystem, aiming to provide reliable and sustainable electricity to support growing infrastructure demands.

- Tata Power Company Ltd.- Partnering with multiple data centres to provide green energy and advanced grid support solutions.

- Sterlite Technologies (STL)- Provides high-speed fiber optic networks and energy-efficient technologies tailored for large-scale hyperscale data centre deployments.

Telecom & Connectivity- Reliable, high-bandwidth networks are crucial for data transfer, edge computing, and cloud connectivity.

- Bharti Airtel- via its subsidiary Nxtra by Airtel, is expanding its data centre footprint across India, currently operating 12 large-scale and 120 edge data centres to keep pace with the growing digital demand.

- Reliance Industries (via Jio Platforms)- Jio is investing heavily in digital infrastructure, with plans for edge cloud and data hosting via Jio Cloud.

IT & Data Centre Services- Companies offering system integration, cooling tech, software-defined infrastructure, and more.

- Tech Mahindra- Recently announced a partnership to offer AI-powered edge computing solutions.

- HCL Tech- Provides infrastructure management, data migration, and cloud-native services for hyperscalers.

- Tata Communications- Offers colocation, cloud hosting, and interconnectivity solutions to global and Indian enterprises.

Investor Takeaway

As India aims to become a global data hub, the ecosystem around data centres is becoming a structural growth story, not just a cyclical theme.

The convergence of real estate, energy, telecom, and tech makes the data centre opportunity a multi-sector investment theme potentially reshaping India's digital and economic landscape by 2027.

Conclusion

India’s data centre boom marks a long-term digital infrastructure shift, driven by AI, 5G, and cloud demand. With ₹2 to ₹2.3 lakh crore investments expected companies across real estate, power, telecom, and IT stand to benefit. For investors, this is a multi-sector opportunity to participate in India’s transformation into a global data hub.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.