PSU Bank Stocks Rally as Government Weighs Raising FIIs Cap to 49%

Source: shutterstock

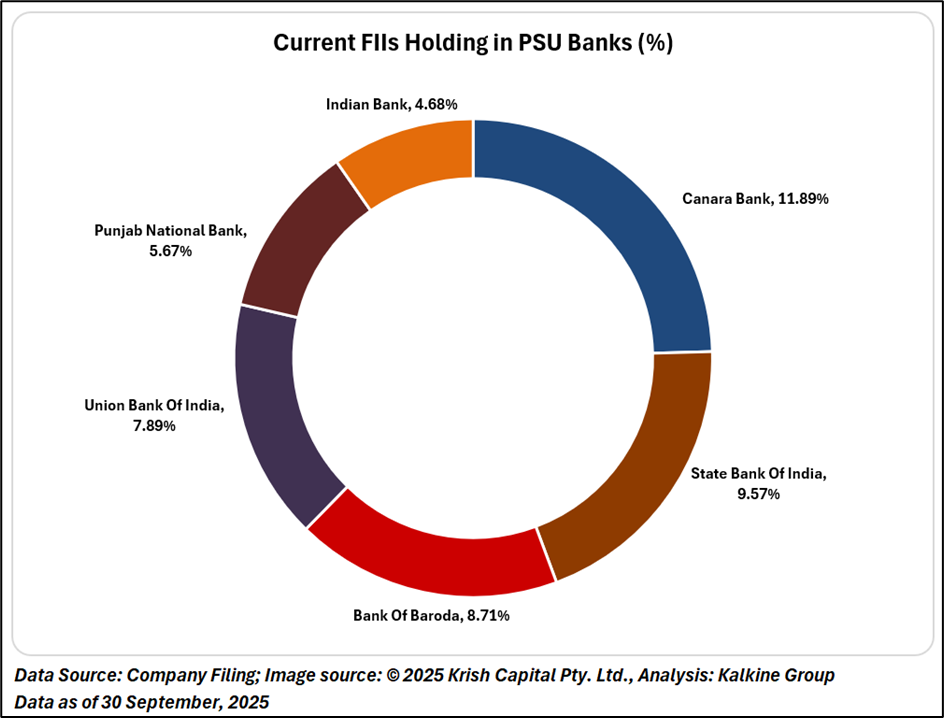

Shares of state-owned banks rallied on Tuesday, October 28, after reports suggested that the government is considering raising the foreign investment ceiling in public sector banks (PSBs) to 49% from the current 20%. The move, if implemented, could significantly enhance foreign capital participation in India’s banking sector and align ownership rules more closely with those governing private banks.

Policy Discussions Underway

According to a Reuters report, the finance ministry has been in discussions with the Reserve Bank of India (RBI) for several months to explore raising the foreign investment cap in government-owned banks. The proposal, however, is still at a preliminary stage and yet to receive formal approval.

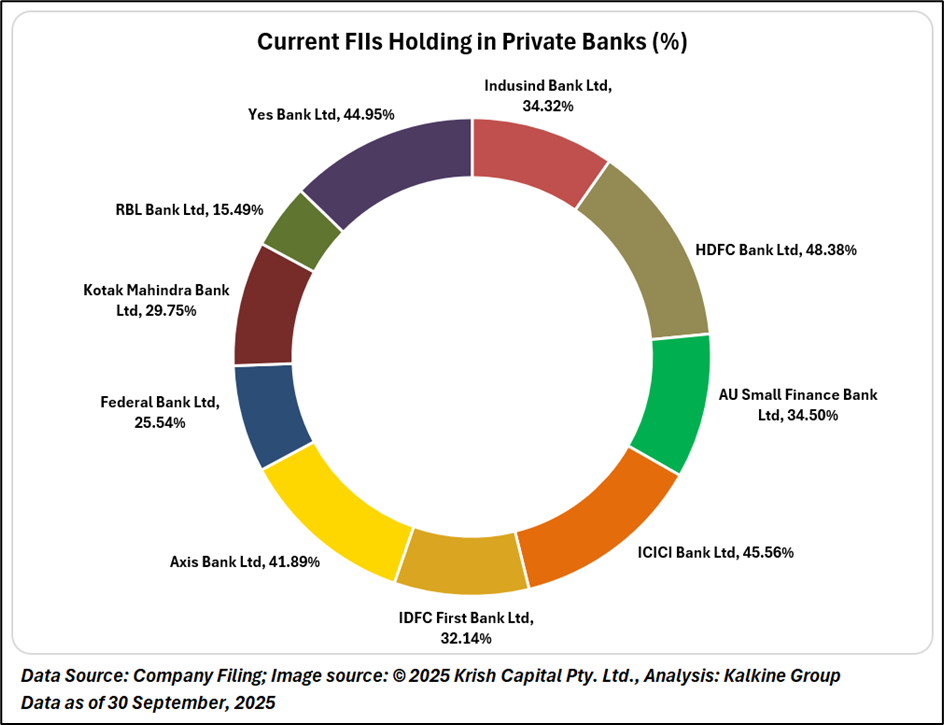

The initiative aims to narrow the regulatory gap between state-run and private banks, where foreign ownership is already allowed up to 74%. By easing investment restrictions, the government hopes to attract more global capital and improve the competitiveness of PSU banks.

Rising Global Interest in Indian Banks

Foreign appetite for Indian banking assets has been increasing steadily. Recent landmark deals include Emirates NBD’s $3 billion acquisition of a 60% stake in RBL Bank and Sumitomo Mitsui Banking Corporation’s $1.6 billion investment for a 20% stake in Yes Bank, later augmented by another 4.99%.

This trend underscores the confidence of global investors in India’s financial sector resilience and long-term growth potential a sentiment that could extend to PSU banks if the ownership cap is relaxed.

Broader Implications

If approved, the increase in foreign investment limits could provide state-owned lenders with fresh capital to strengthen balance sheets, enhance governance standards, and accelerate digital transformation initiatives. It could also improve liquidity and expand institutional participation in the PSU banking space areas that have historically trailed private sector peers.

Technical Analysis

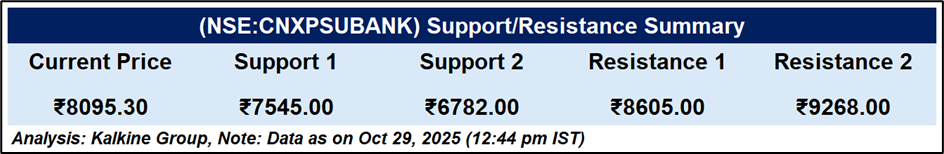

The Nifty PSU Bank Index sustained its upward momentum, closing at 8,095.30, near record highs. The index remains well above the 51-day EMA (7,450), indicating strong trend support. The RSI at 73.5 signals overbought conditions, suggesting potential short-term consolidation while maintaining a robust medium-term bullish bias.

Conclusion

The proposed hike in the foreign investment cap could mark a turning point for PSU banks, unlocking new capital inflows and aligning them more closely with private peers. While near-term market consolidation is possible, the medium-term outlook remains positive, driven by reform momentum and improving investor confidence in India’s banking sector.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.