Record Festive Sales Propel India’s Passenger Vehicle Market to New Highs

Source: shutterstock

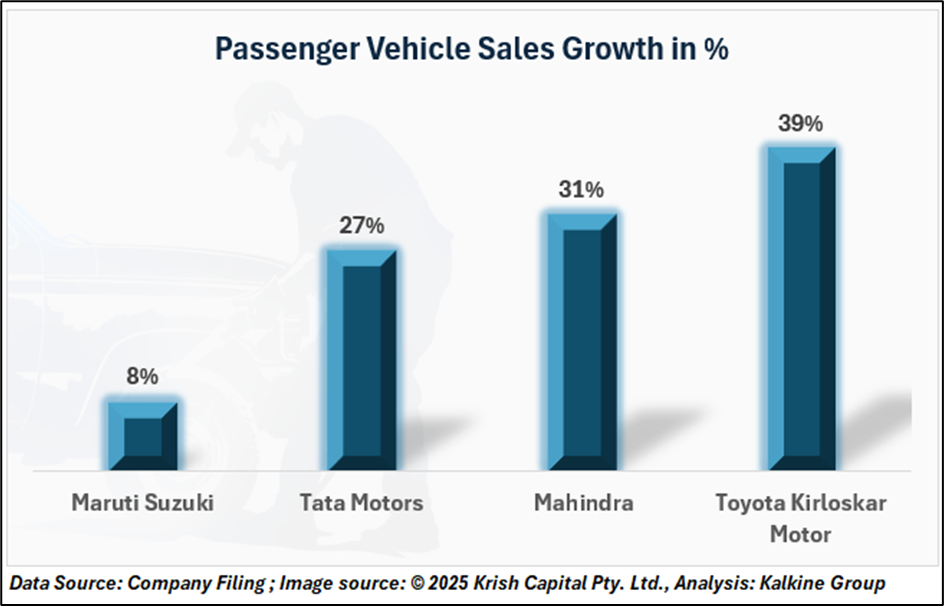

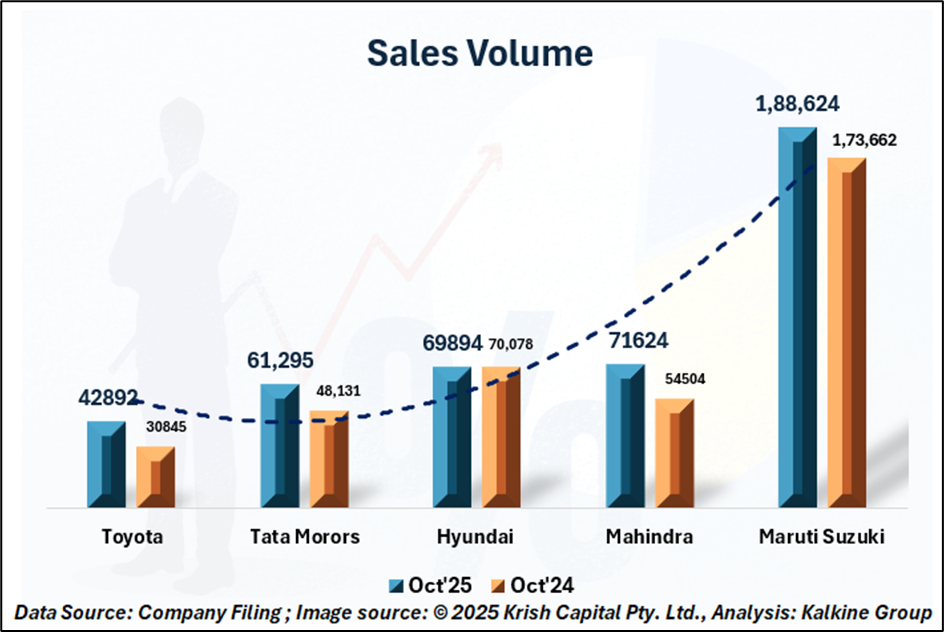

India’s passenger vehicle market witnessed record sales in October 2025, driven by strong festive season demand and sustained interest in sport-utility vehicles (SUVs). According to company filings on the BSE and official releases, major automakers including Maruti Suzuki, Mahindra & Mahindra, Tata Motors, and Toyota Kirloskar Motor reported high-digit year-on-year (YoY) growth across key segments.

Passenger Vehicle Momentum Strengthens

Overall passenger vehicle (PV) sales in October 2025 reflected one of the industry’s best monthly performances in recent years. Market sentiment improved significantly during the festive period, supported by new model launches, promotional offers, and improving consumer confidence.

Tata Motors recorded a robust 26.6% YoY rise in PV sales to 61,295 units, up from 48,423 units in October 2024. Domestic PV sales, including electric vehicles (EVs), stood at 61,134 units, while EV volumes surged 73.4% YoY to 9,286 units, underscoring the growing acceptance of electric mobility.

On the commercial vehicle front, Tata’s total CV sales rose 10% YoY to 37,530 units, aided by improved freight movement and infrastructure demand.

Maruti Suzuki maintained its leadership position with total production of 192,139 units, an 8.3% YoY increase. Passenger vehicle production reached 188,624 units, driven by compact and utility models such as the Baleno, Swift, Brezza, and Ertiga, while light commercial output remained steady at 3,515 units.

SUV Segment Continues to Dominate

The SUV category remained the key growth driver across brands. Mahindra & Mahindra posted another strong month, with utility vehicle sales rising 31% YoY to 71,624 units, led by the Scorpio, XUV700, and Thar. Hyundai Motor India sold 69,894 units during the month, marginally lower than last year’s total but supported by an 11% rise in exports to 16,102 units. The company’s popular SUVs — Creta and Venue — contributed a combined 30,119 units, marking their second-highest monthly total on record. Toyota Kirloskar Motor continued its upward trajectory, with total sales rising 39% YoY to 42,892 units, boosted by strong demand for the Innova HyCross and Urban Cruiser Hyryder.

Festive Push and Market Outlook

The month’s record-breaking performance coincided with India’s major festive calendar Navratri, Dussehra, Dhanteras, and Diwali which traditionally stimulates discretionary purchases such as cars and two-wheelers.

At the same time, temporary relief in Goods and Services Tax (GST) adjustments on select models helped moderate prices, further strengthening retail demand. Dealers reported higher footfalls and faster inventory turnover, supported by improved vehicle availability and financing offers.

Technical Summary

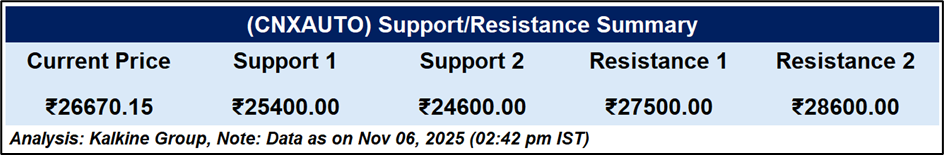

The Nifty Auto Index remains in a primary uptrend, trading above the 51-day EMA (26,415), though short-term momentum has softened. The RSI at 45 indicates weakening strength. Key support is placed at 24,400–24,600, with resistance near 27,500–28,600. Sustaining above the EMA maintains bullish structure; below it, a corrective phase may emerge.

Conclusion

India’s passenger vehicle sector delivered record October 2025 sales, underscoring robust festive demand and SUV dominance. Strong performances by Maruti Suzuki, Tata Motors, Mahindra & Mahindra, and Toyota highlight resilient consumer sentiment. With stable macroeconomic conditions and sustained retail momentum, the industry’s growth outlook remains positive despite near-term technical consolidation.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.