Source: shutterstock

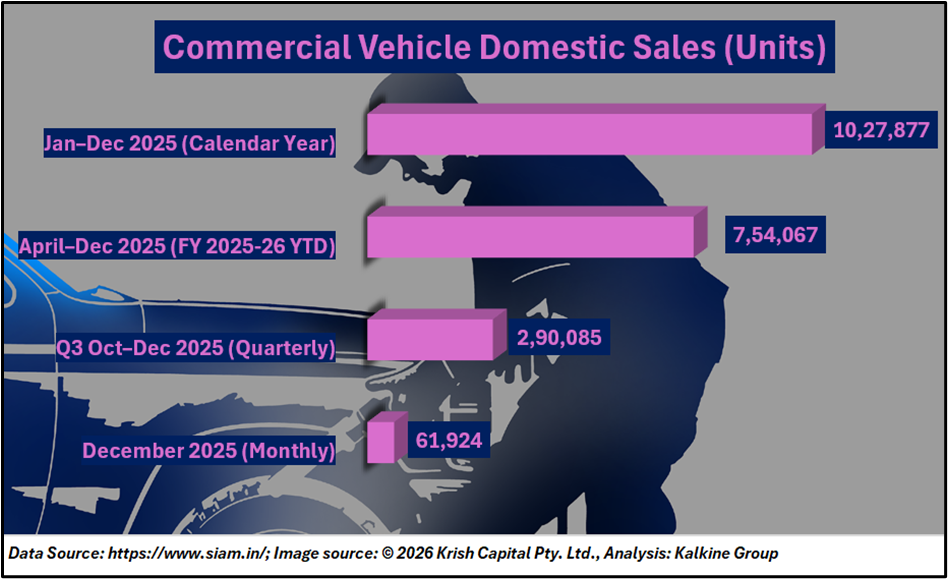

India’s commercial vehicle (CV) industry is heading for a record year in fiscal 2026 (FY26), with sales expected to surpass 1.07 million units the previous high seen in FY19. This growth is driven by replacement demand, following a cut in goods and services tax (GST), more government spending on infrastructure, and better utilisation of trucks and buses in the freight and logistics sectors.

Industry experts believe this strong momentum will continue into FY27, making it one of the best periods for CV manufacturers in recent years. Sales are expected to rise across all segments, including heavy, medium, and light commercial vehicles.

Why Sales Are Rising

A major reason for the surge is the GST cut on commercial vehicles from 28% to 18% in September 2025. This made new trucks and buses more affordable, especially for small and medium fleet operators. At the same time, India’s CV fleet is aging, with an average age of 11 years, so many old vehicles are being replaced with new, more efficient models.

As a result, CV sales jumped 21.5% in the October–December quarter compared to last year, and year-to-date sales are also showing strong growth.

Companies Benefiting the Most

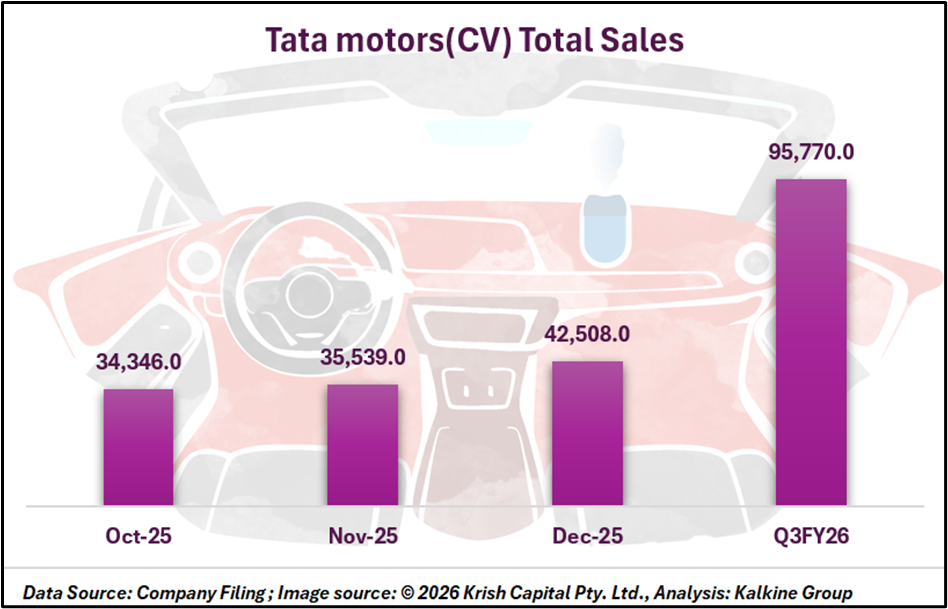

1.Tata Motors (NSE: TMCV)

Tata Motors leads the Indian CV market with a wide range of buses, trucks, and logistics vehicles. Its focus on intermediate, light, and medium commercial vehicles (ILMCVs) has driven strong demand. Tata is also investing in high-capacity and multi-axle trucks to meet the growing freight needs of sectors like e-commerce, steel, cement, and automotive parts.

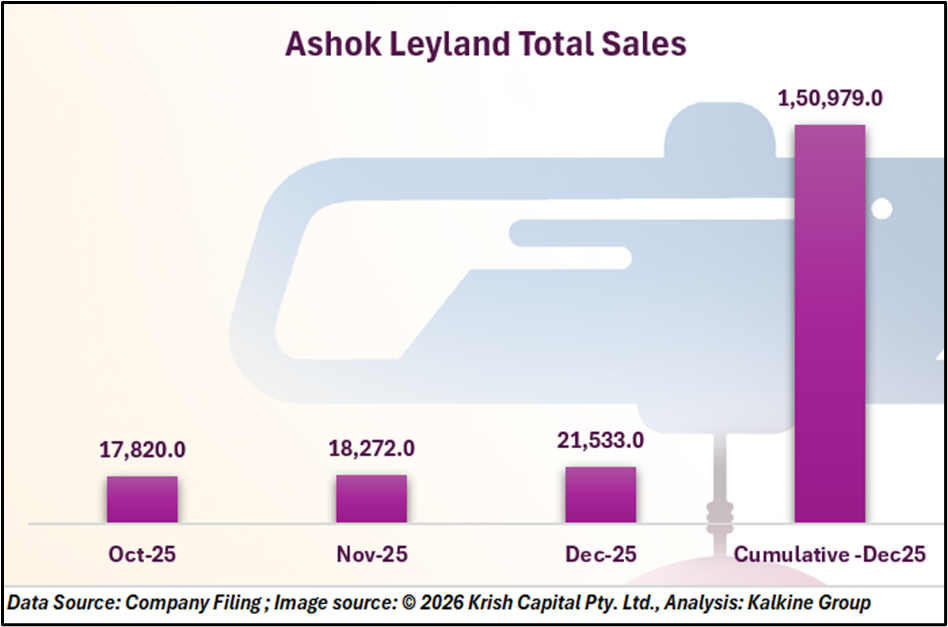

2.Ashok Leyland (NSE: ASHOKLEY)

India’s second-largest CV maker, Ashok Leyland, is seeing strong growth across both heavy and light commercial vehicles. Higher freight rates, better economics for truck operators, and increased exports have helped the company strengthen its market share.

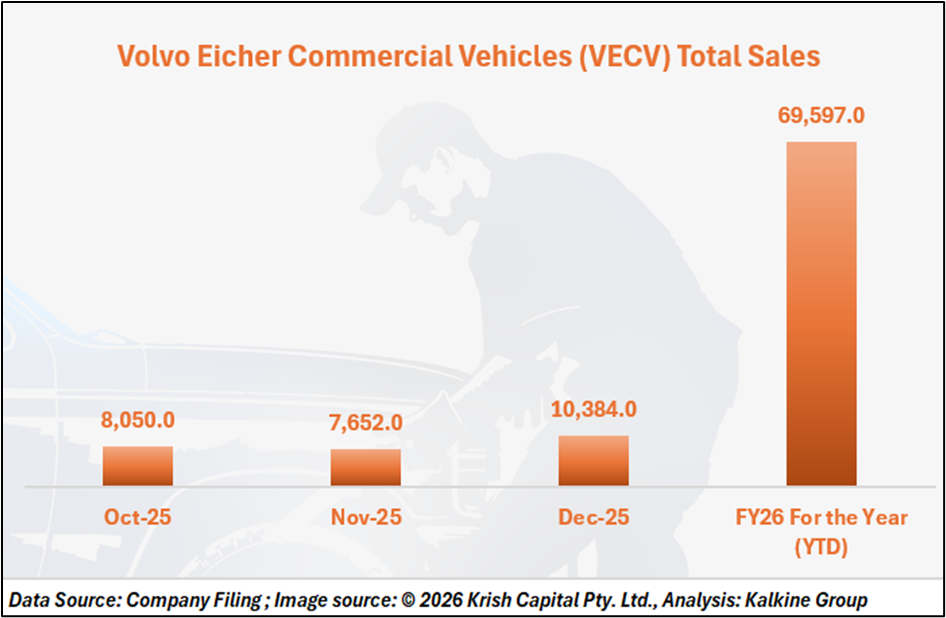

3. Eicher Motors Ltd (NSE: EICHERMOT)

Eicher Motors is present in the commercial vehicle segment through its joint venture, Volvo Eicher Commercial Vehicles (VECV). The company is expanding its presence in the light and medium-duty segments with a broader product portfolio that includes diesel, CNG, and electric vehicles. It is also increasing its focus on rural and regional markets, which is expected to support higher sales volumes.

Conclusion

The expected surge in commercial vehicle sales in FY26 reflects a structural recovery rather than a short-term spike. Replacement demand triggered by GST rationalisation, coupled with an ageing fleet and improving freight activity, has created sustained momentum across CV segments.

Market leaders such as Tata Motors, Ashok Leyland, and Eicher Motors are positioned to benefit from higher volumes as fleet operators upgrade to newer, more efficient vehicles. With infrastructure spending and logistics activity remaining supportive, the CV cycle appears set to remain favourable into FY27, reinforcing the sector’s importance within India’s broader industrial and transport ecosystem.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.