Shareholders Approve Swiggy’s ₹10,000-Crore QIP Plan

Source: shutterstock

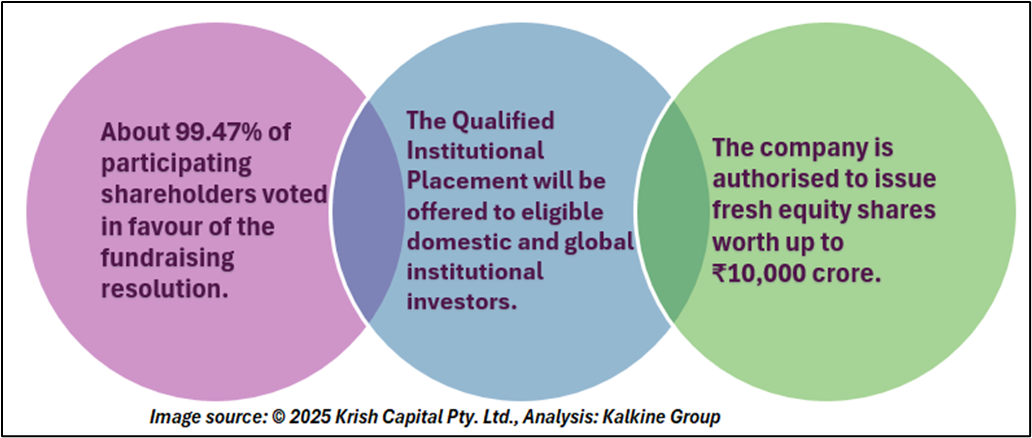

Swiggy has formally kicked off plans to raise up to ₹10,000 crore through a Qualified Institutional Placement (QIP), following approval from its shareholders. The decision was cleared at the company’s Extraordinary General Meeting (EGM) held on December 8, where the proposal received strong backing.

According to a stock exchange filing, about 76.4% of shareholders participated in the vote, and an overwhelming 99.47% voted in favour of the fundraising plan. The approval paves the way for one of the largest equity fundraises in India’s consumer internet sector this year.

What happens next?

With shareholder approval in place, Swiggy will now approach large institutional investors, including domestic long-only funds and global investors. While the company has not yet announced the exact opening date of the QIP, eligible investors will be able to buy fresh shares directly from Swiggy once the issue opens. As per the resolution, the company is authorised to issue new equity shares worth up to ₹10,000 crore.

The funds raised will help Swiggy build a stronger cash position to support its core businesses such as food delivery, quick commerce arm Instamart, and other emerging services.

Why Swiggy is raising funds now

The primary reason behind the fundraising is intensifying competition, especially in the quick commerce segment. This space requires significant capital to set up dark stores, logistics infrastructure, delivery manpower and technology systems.

Swiggy’s Instamart faces stiff competition from Blinkit and Zepto, both of which are investing aggressively. Blinkit has raised around ₹2,100 crore this year, including a recent ₹600-crore infusion, while Zepto secured $450 million in a recent funding round. The battle for leadership in quick commerce is expected to remain capital-intensive in the coming quarters.

Financial performance snapshot

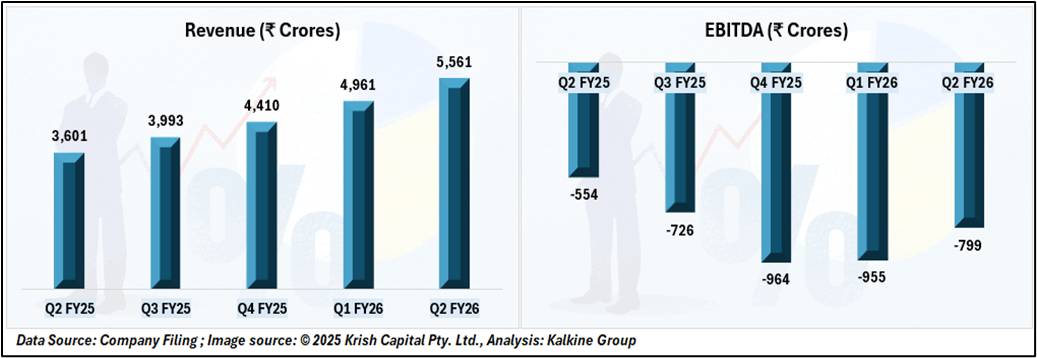

Swiggy has reported steady revenue growth over recent quarters. Revenue increased from ₹3,601 crore in Q2 FY25 to ₹5,561 crore in Q2 FY26. However, profitability remains a challenge. EBITDA stayed negative during this period, though losses narrowed from ₹955 crore in Q1 FY26 to ₹799 crore in Q2 FY26, with margins improving to -14%.

Technical Analysis

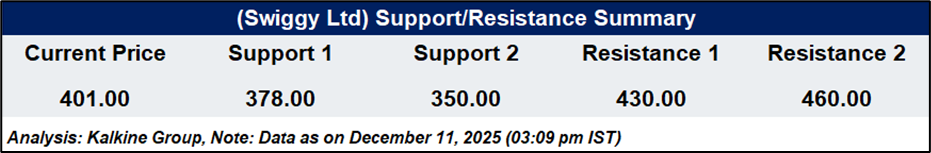

The Swiggy is currently trading at ₹401 per share. Immediate support levels are at ₹378 and ₹350, indicating potential buying zones. On the upside, resistance is seen at ₹430 and 460, which could act as selling pressure points. These key levels help traders gauge potential price movements and plan entry or exit strategies effectively.

Conclusion

Swiggy’s shareholder approval for a ₹10,000-crore Qualified Institutional Placement marks a key step in securing additional capital amid rising competitive pressures. The proposed fundraise enables the company to approach institutional investors for fresh equity issuance while addressing funding needs across food delivery and quick commerce operations. At the same time, recent financials reflect revenue growth alongside continued losses, highlighting the capital-intensive nature of the business environment in which Swiggy operates.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.