Strong Global Demand Fuels a 24% Surge in India’s Automobile Exports

Source: shutterstock

India’s automobile industry delivered a robust performance in calendar year 2025, with exports rising 24%, highlighting the sector’s increasing global competitiveness. Rising overseas demand and cost-efficient manufacturing enabled Indian automakers to expand their footprint across key international markets.

Passenger vehicles (PV), two-wheelers (2W), and commercial vehicles (CV) all posted healthy export growth, supported by deeper penetration into emerging regions such as Africa, Latin America, and parts of Asia, along with growing acceptance of Indian-made vehicles in developed markets.

Manufacturing Scale, Localisation, and Policy Support

A major driver of export momentum was the industry’s ability to scale production efficiently while maintaining cost competitiveness amid global economic uncertainty. Higher localisation of components, capacity expansion, and supportive government policies strengthened the sector’s resilience.

Automakers also increased investments to meet international safety and emission norms and diversified their product portfolios to suit varying global market needs, reinforcing India’s position as a reliable automotive manufacturing hub.

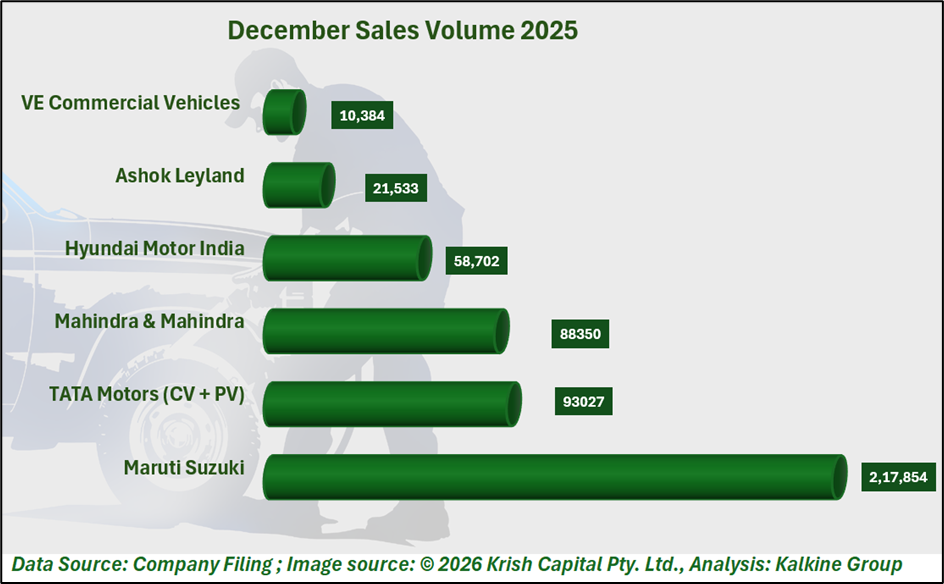

OEM Sales Snapshot

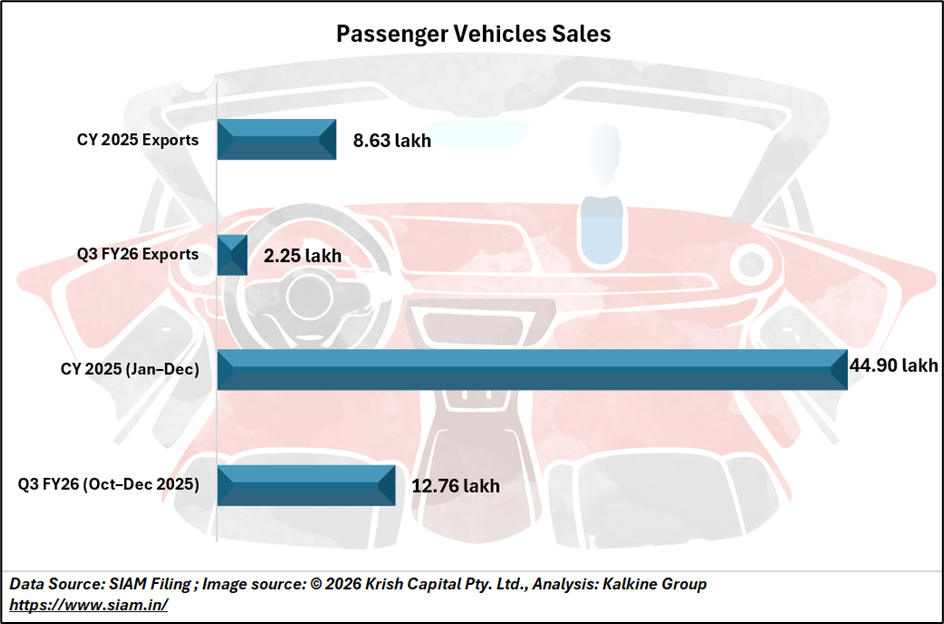

Passenger Vehicles Maintain Steady Domestic and Export Growth

Passenger vehicle sales remained firm during the year, with full calendar year 2025 volumes reaching 44.90 lakh units, reflecting a 5.0% year-on-year increase. Export performance was equally encouraging, with PV exports totaling 2.25 lakh units in Q3, up 11.7% YoY. For the full year, exports reached 8.63 lakh units, registering a solid 16.0% growth and underscoring sustained demand for Indian passenger vehicles overseas.

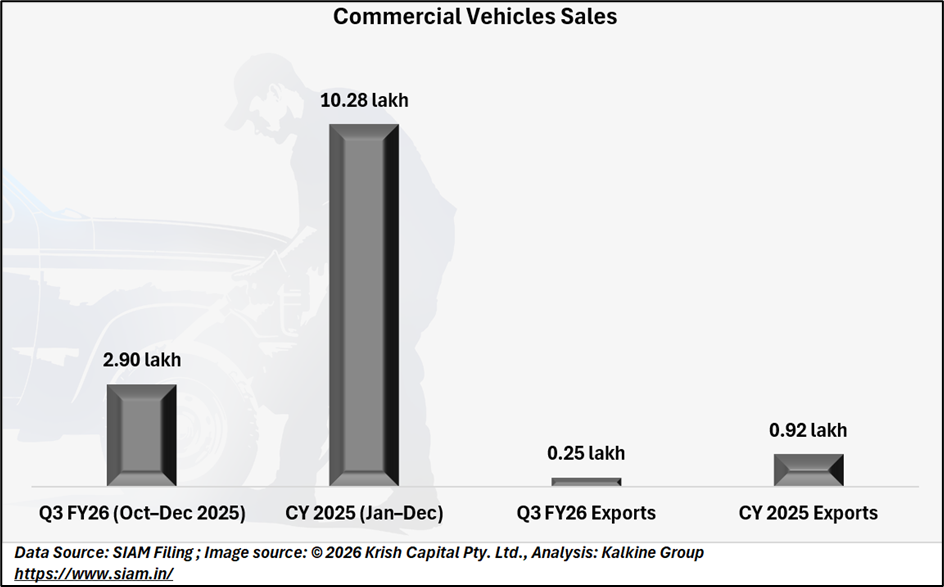

Commercial Vehicles Benefit from Infrastructure and Exports

The commercial vehicle segment recorded strong momentum, aided by infrastructure activity and improving economic conditions. CV sales stood at 2.90 lakh units in Q3, rising 21.5% YoY, while full-year sales reached 10.28 lakh units, up 7.7%. Exports outperformed domestic growth, with Q3 exports at 0.25 lakh units (+13.6%) and annual exports at 0.92 lakh units, marking a sharp 27.1% increase and highlighting exports as a key growth driver.

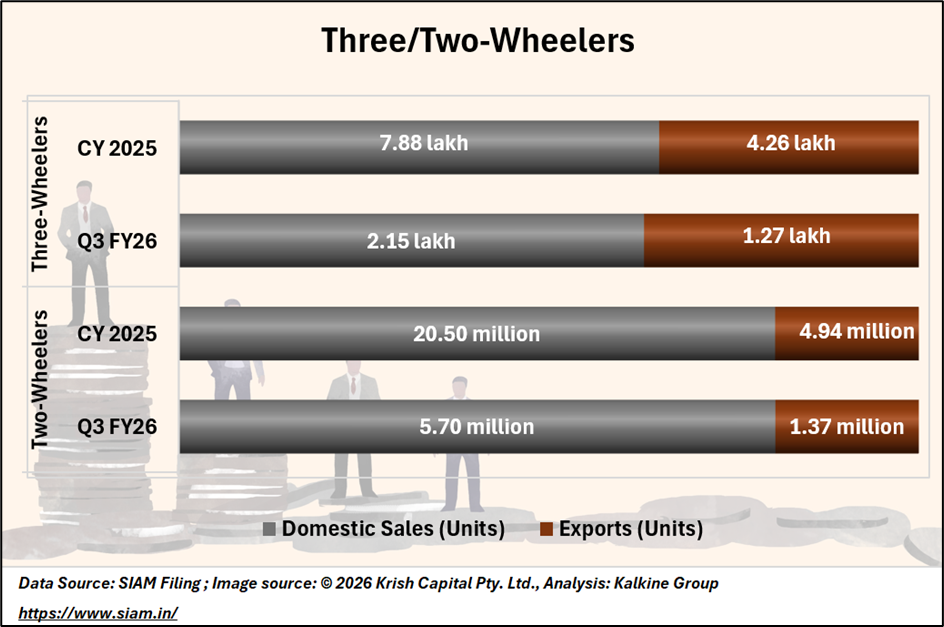

Two-Wheelers Lead Volumes, Three-Wheelers Shine in Exports

Two-wheelers remained the volume driver, with Q3 sales crossing 5.70 million units, up 16.9% YoY, while CY 2025 sales rose 4.9% to 20.50 million units. Exports were strong, jumping 24.3% YoY in Q3 to 1.37 million units and 24.2% for the year to 4.94 million units, supported by robust urban demand, the GST 2.0 rollout, and supportive macro policies. Three-wheelers also delivered solid growth, with sales up 14.0% YoY in Q3 and 8.2% for CY 2025. Exports outperformed sharply, surging 70.1% YoY in Q3 and 42.7% for the year, driven by rising demand from Sri Lanka and African markets.

Outlook Remains Positive Entering Q4 FY26

As the industry enters Q4 FY26, growth momentum remains intact. Stable macroeconomic conditions, ongoing policy reforms, and favorable financing options are expected to support both domestic sales and exports. However, industry participants continue to monitor supply chain resilience and geopolitical developments. Overall, strong fundamentals and diversified demand position India’s automobile sector well for sustained growth ahead.

Conclusion

India’s automobile industry enters Q4 FY26 on a strong footing, supported by robust export growth, scale-driven cost efficiency, and policy support. Diversified global demand, improving domestic conditions, and rising localisation underpin a positive outlook, despite ongoing geopolitical and supply-chain uncertainties.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.